Reconciliation Center: Transaction Types after Categorization

1. Access the Reconciliation Center by following these steps: How to access the reconciliation center.

2. You can effortlessly browse the main menu options in the Reconciliation Center for 'Transaction Types'.

3. Once transactions have been categorized in Docyt, they are organized into different categories based on their nature. You can click on any of the Transaction Types categories to access the list of transactions that have been classified accordingly. The available categories under Transaction Types include Expense, Income, Bank Transfers, Payroll Charges, Equity/Liabilities/Assets, and Loan Payments.

4. To search and filter transactions in each list, utilize the header row. By checking the 'Show only flagged transactions' option, you can filter the list to display only flagged transactions.

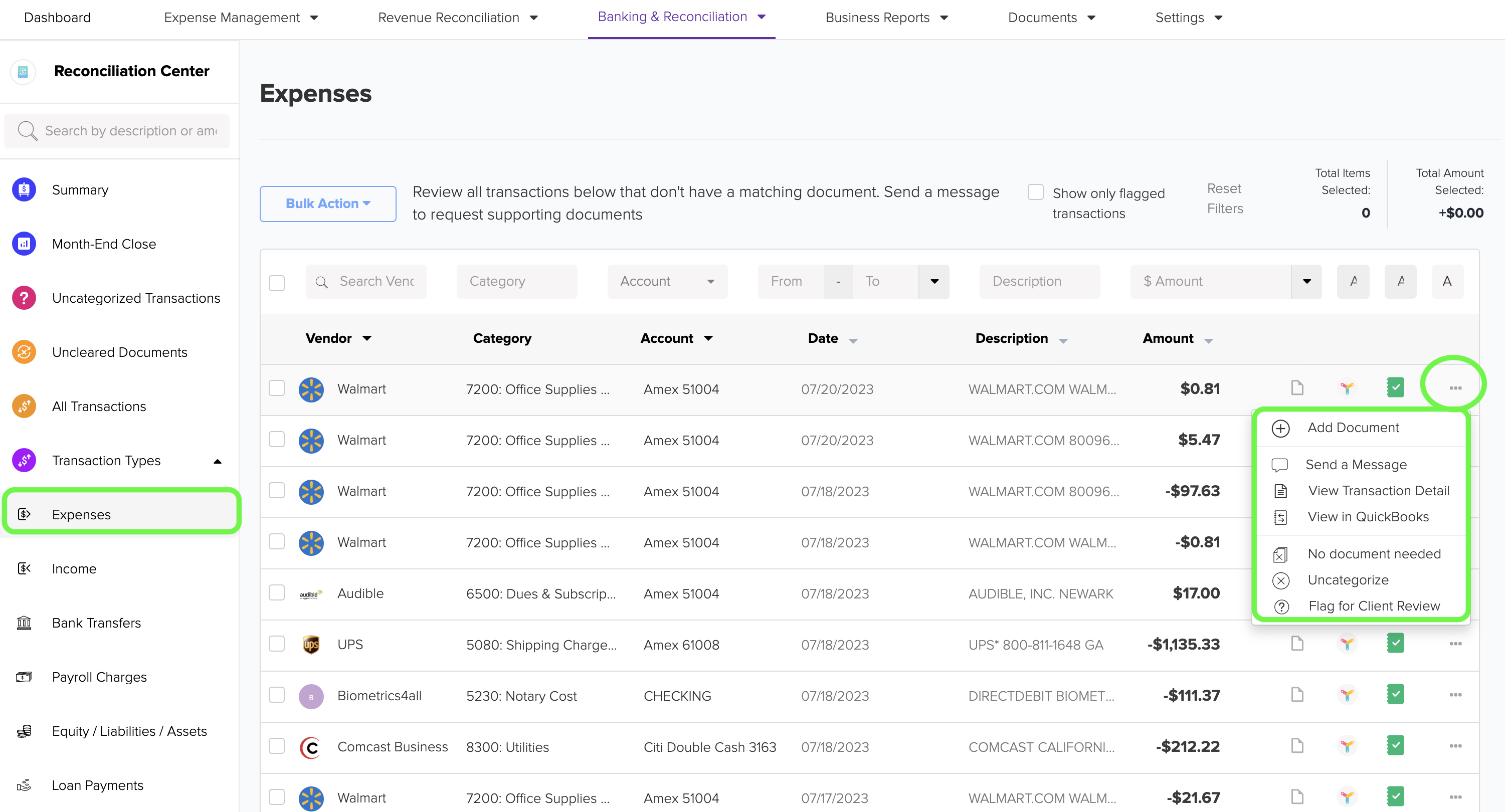

5. Expense: Expense transactions in the Reconciliation Center reflect the expenses and costs that a business has accumulated. You can access these transactions by clicking on the 'Expenses' menu option.

6. To access additional options for an expense transaction, click on the ellipsis menu. If you choose the 'Uncategorize' option, the transaction will be returned to the list of 'Uncategorized Transactions'.

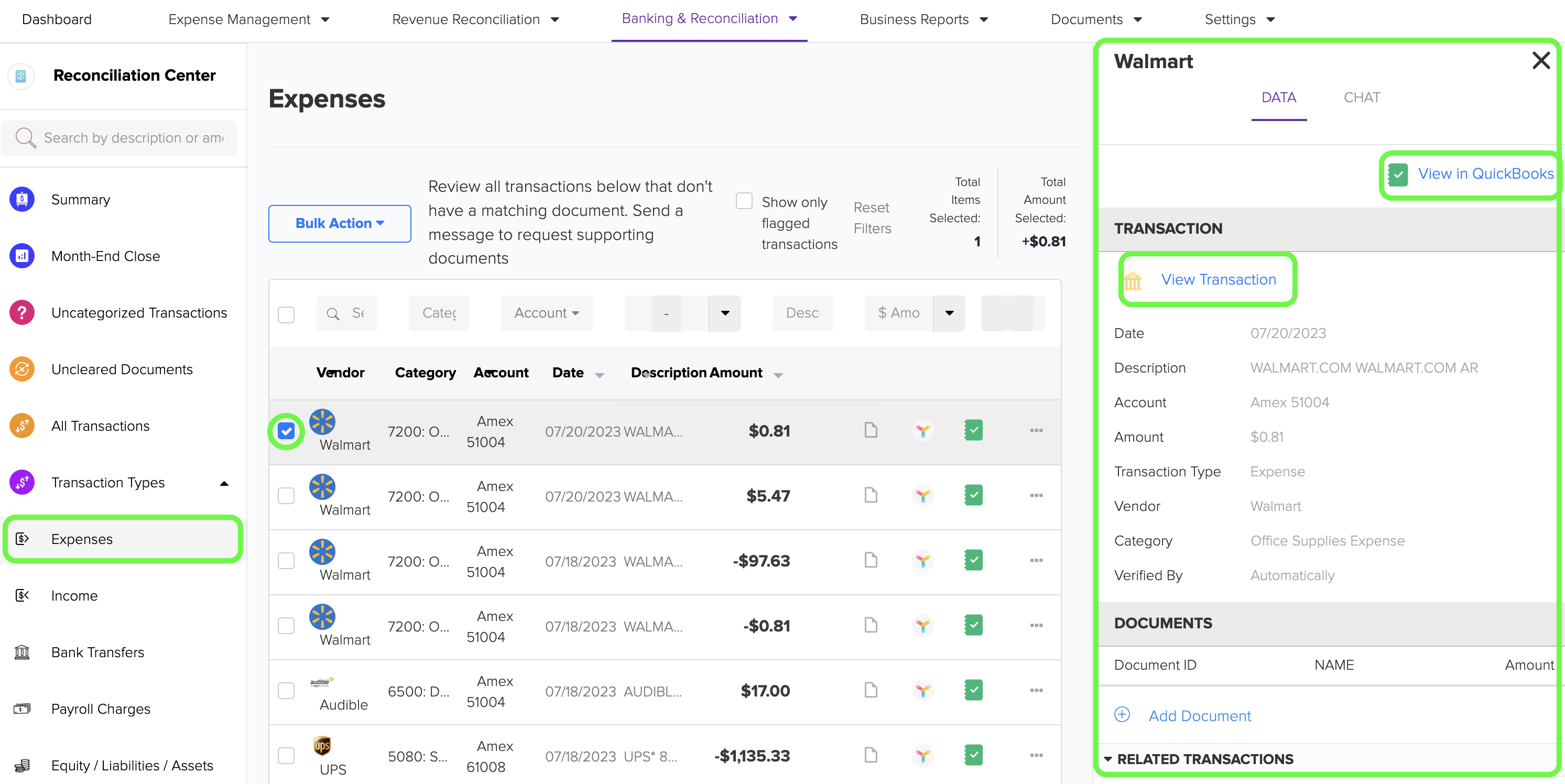

7. When you click on the checkbox of any transaction, a new section will appear on the right side. In this section, you will find links that enable you to directly access QuickBooks and view the specific details of the expense transaction.

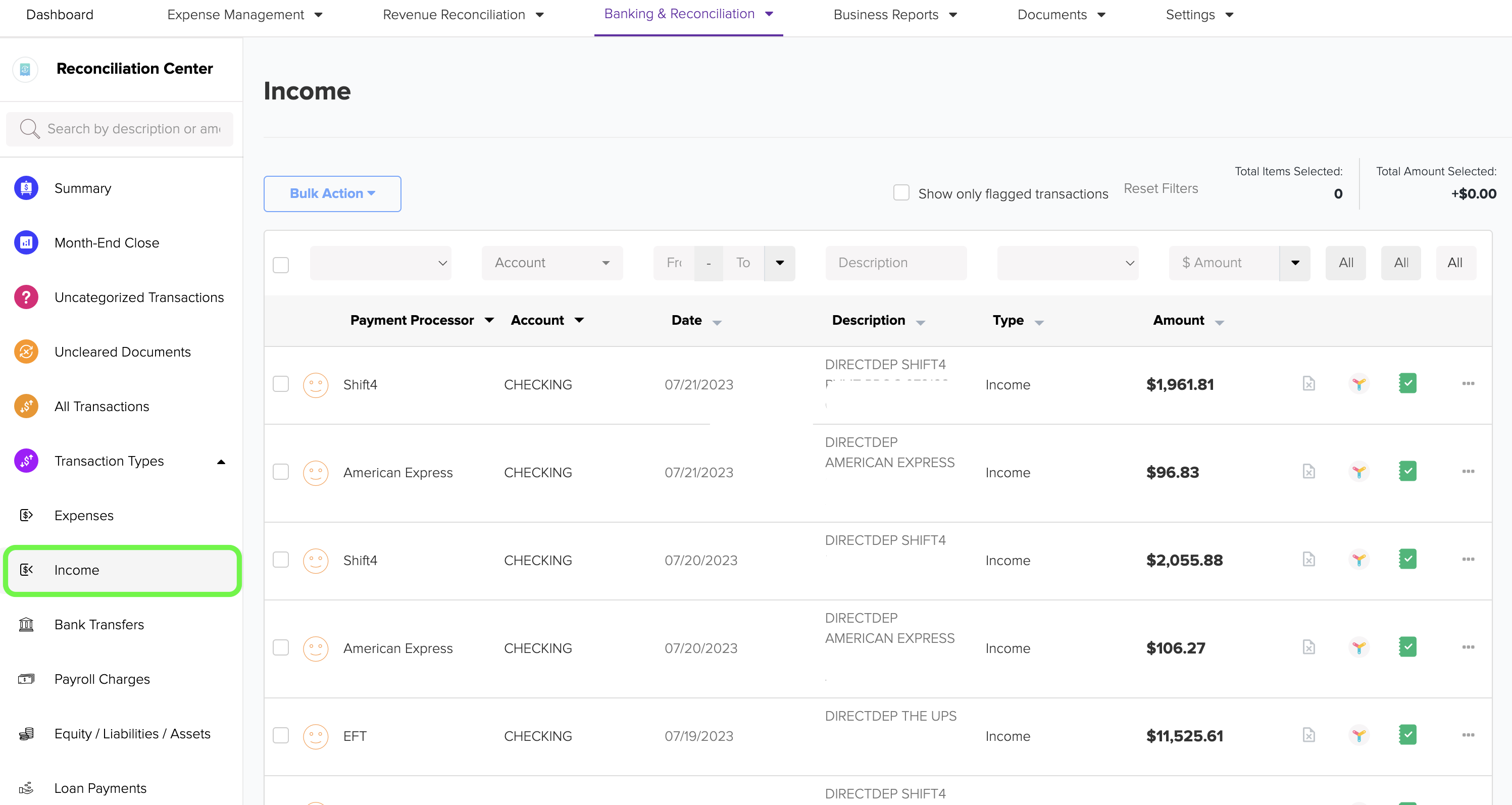

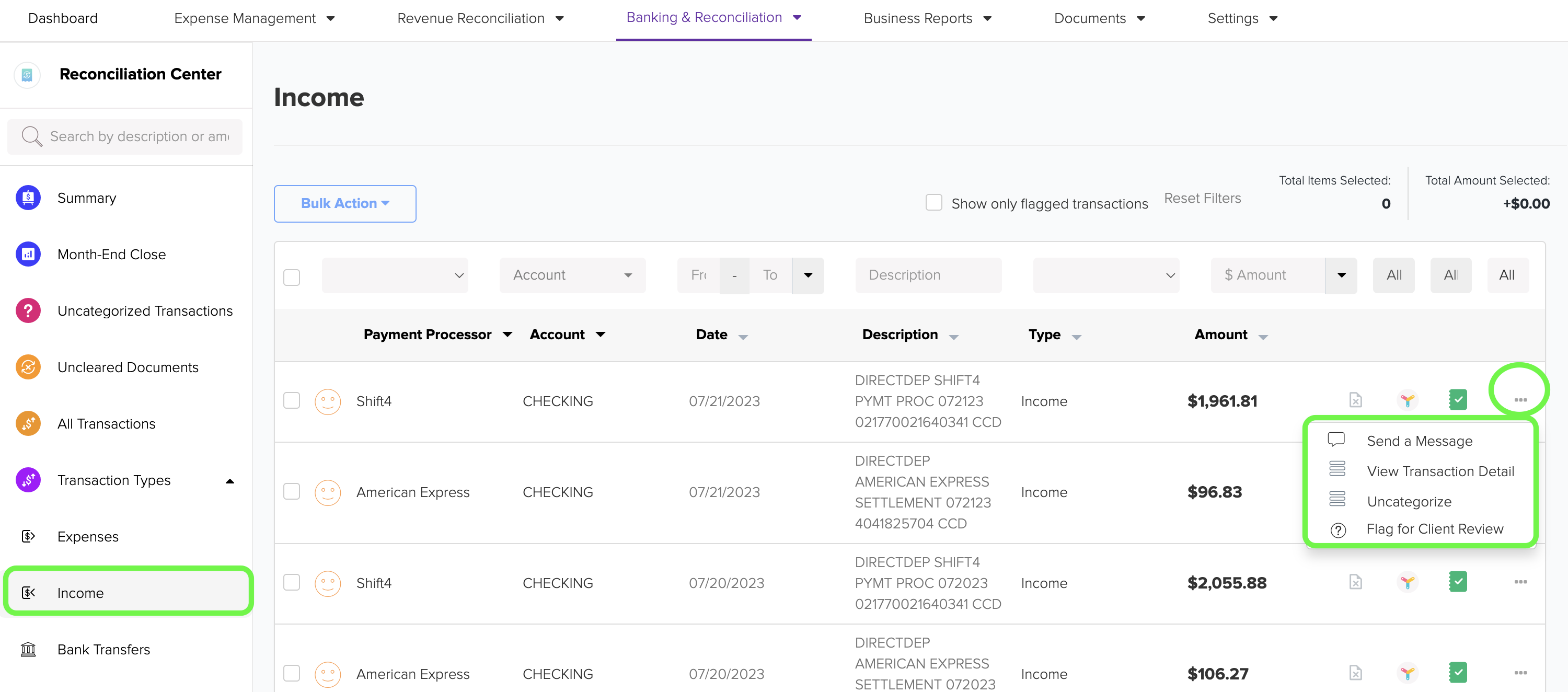

8. Income: Income transactions represent the funds that a business earns from its daily operations. To access these transactions, click on the 'Income' menu option.

9. To access additional options for an income transaction, click on the ellipsis menu. From there, you can explore various other options for the transaction. If you choose to 'Uncategorize' the transaction, it will be returned to the 'Uncategorized Transactions' list.

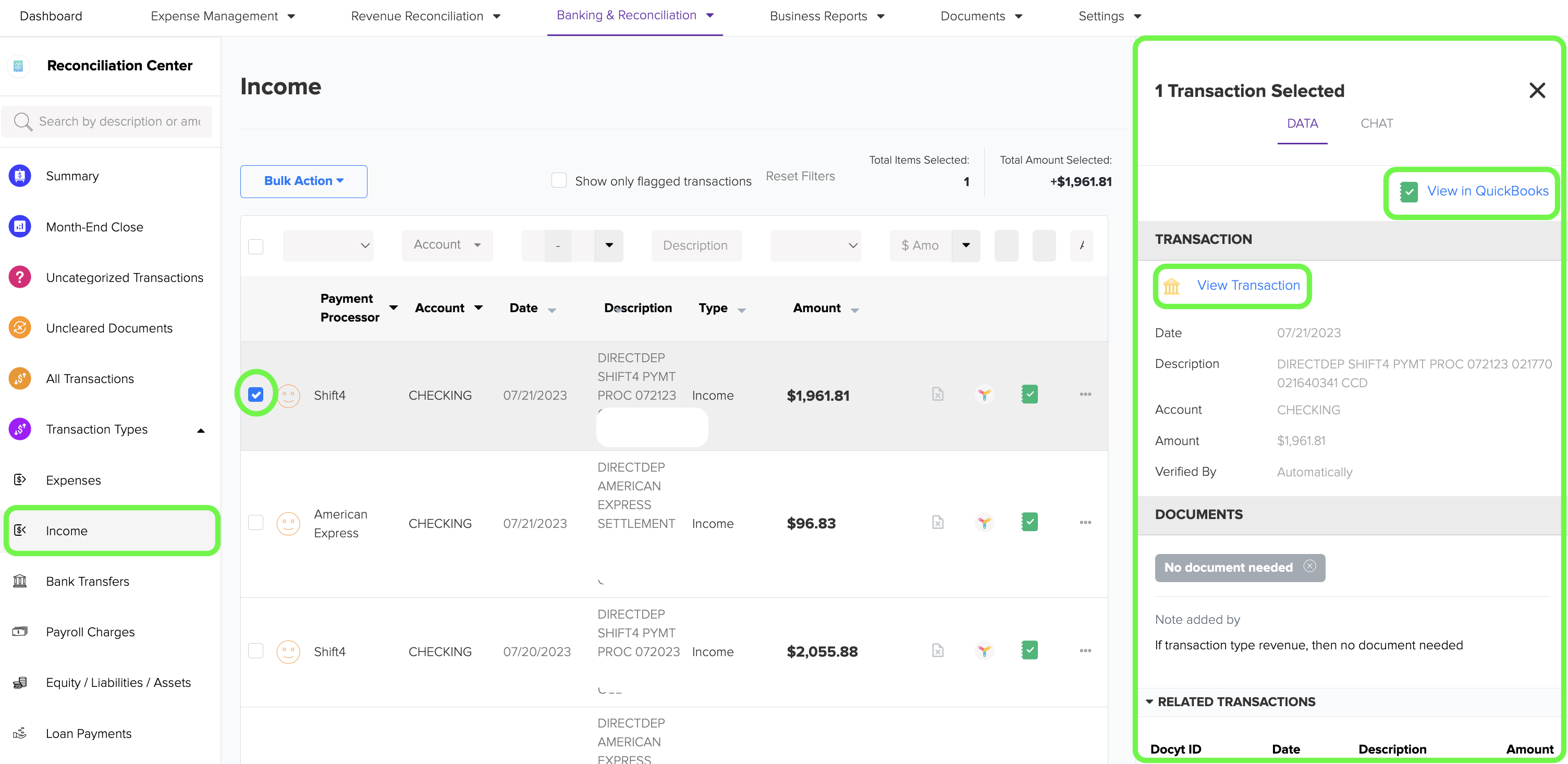

10. Clicking on the checkbox of any transaction will open a new section on the right side. This section will contain links that allow you to directly access QuickBooks and view the details of the income transaction.

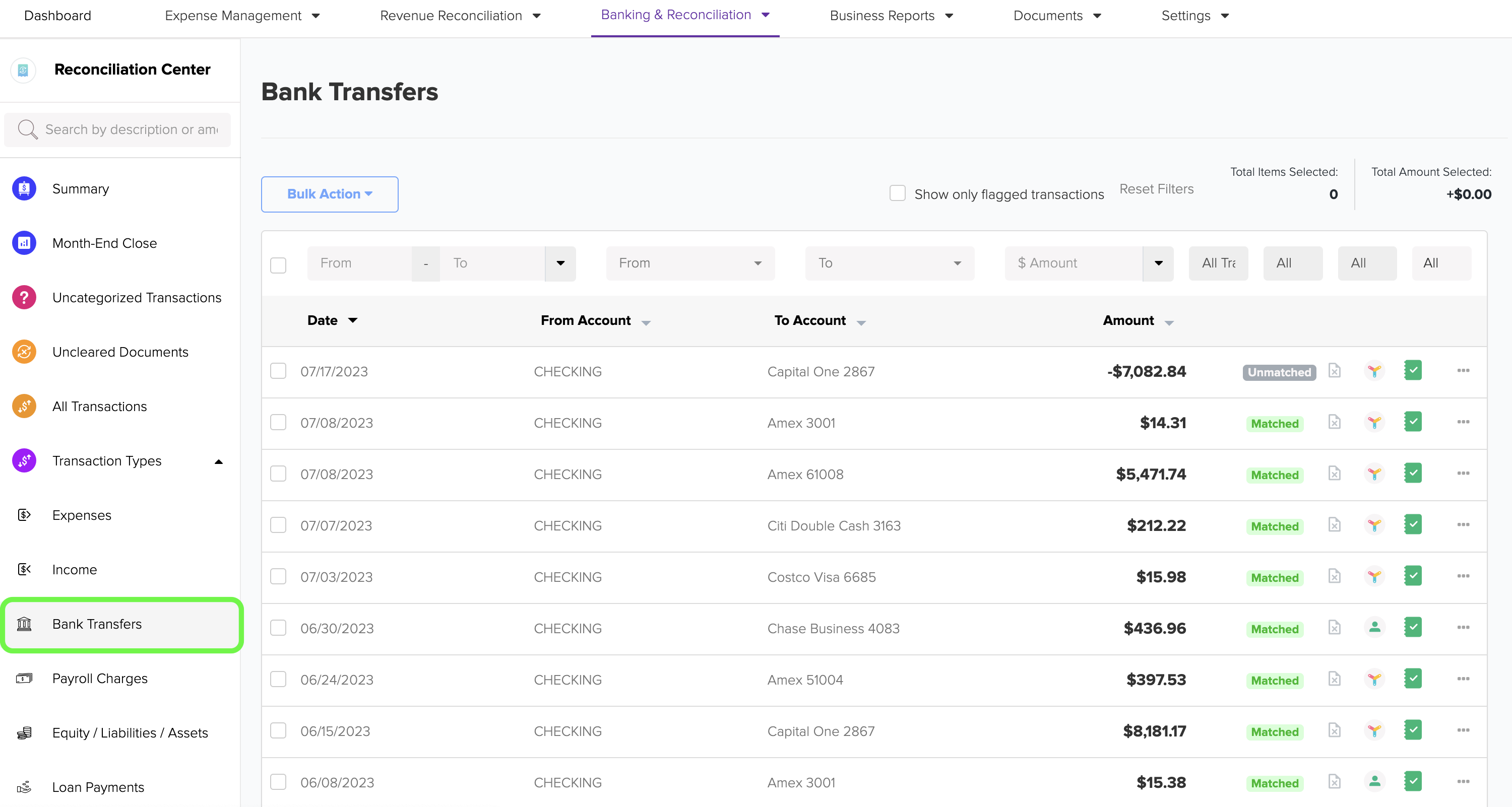

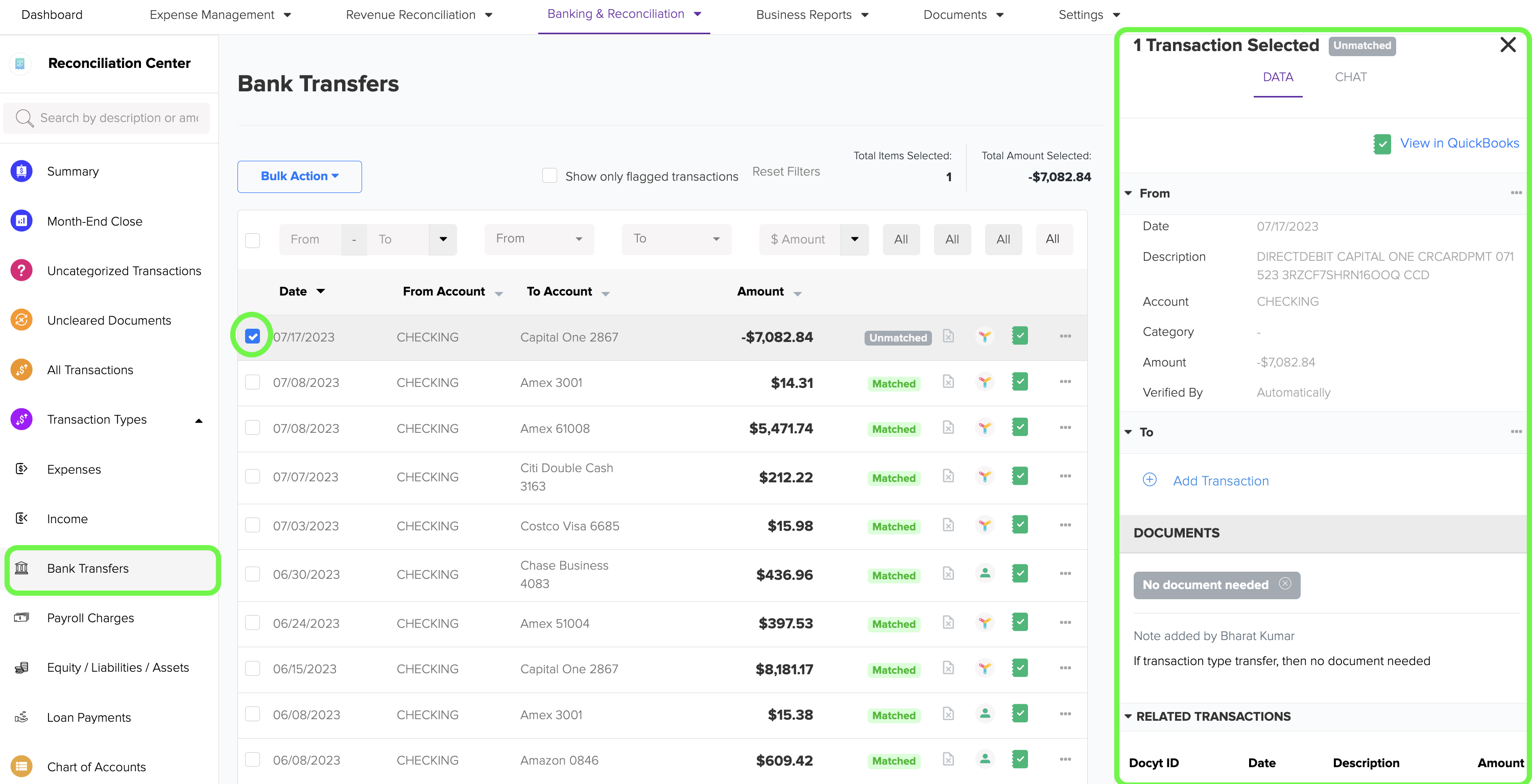

11. Bank Transfers: A transfer is a transaction that moves funds between any two banking accounts, including credit card accounts, of the business. It allows you to quickly transfer money from one account to another within your business's financial system. You can access these transactions by clicking on the 'Bank Transfers' menu option.

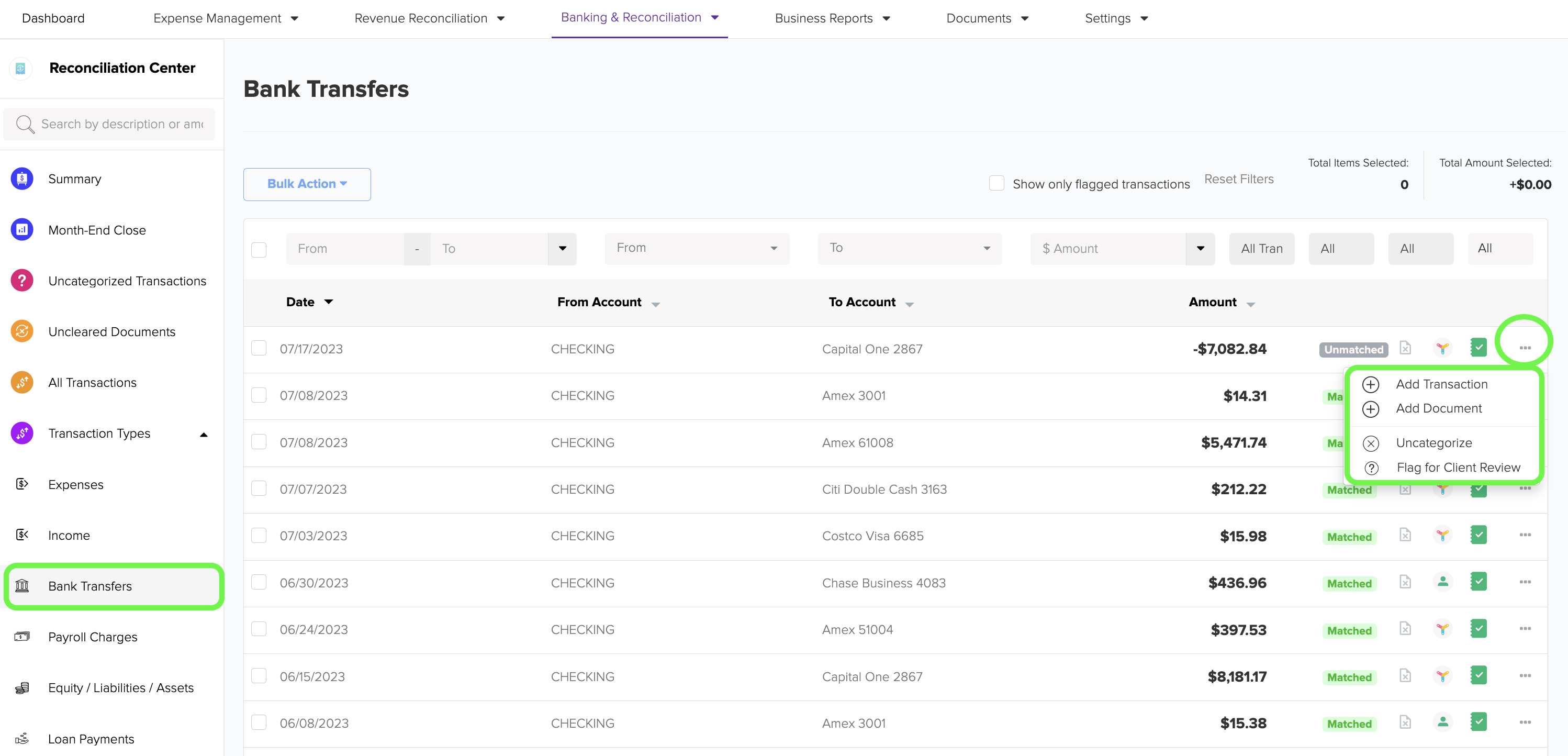

12. To access additional options for a bank transfer transaction, click on the ellipsis menu. From there, you can explore various other options for the transaction. If you choose to 'Uncategorize' the transaction, it will be returned to the list of 'Uncategorized Transactions'.

13. Clicking on the checkbox of any transaction will reveal a new section on the right side. In this section, you will find convenient links that enable you to directly access QuickBooks and view the specific details of the bank transfer transaction.

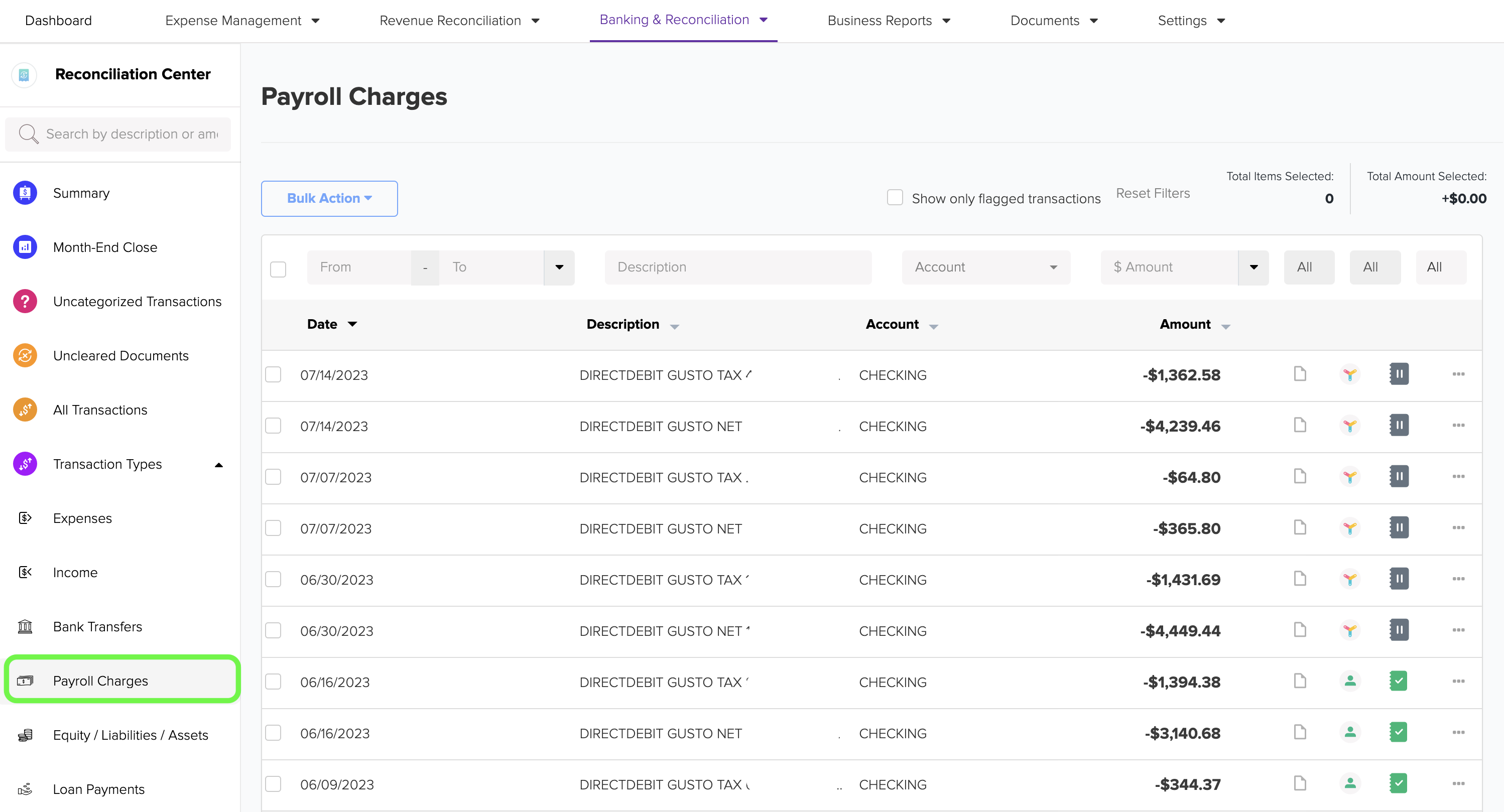

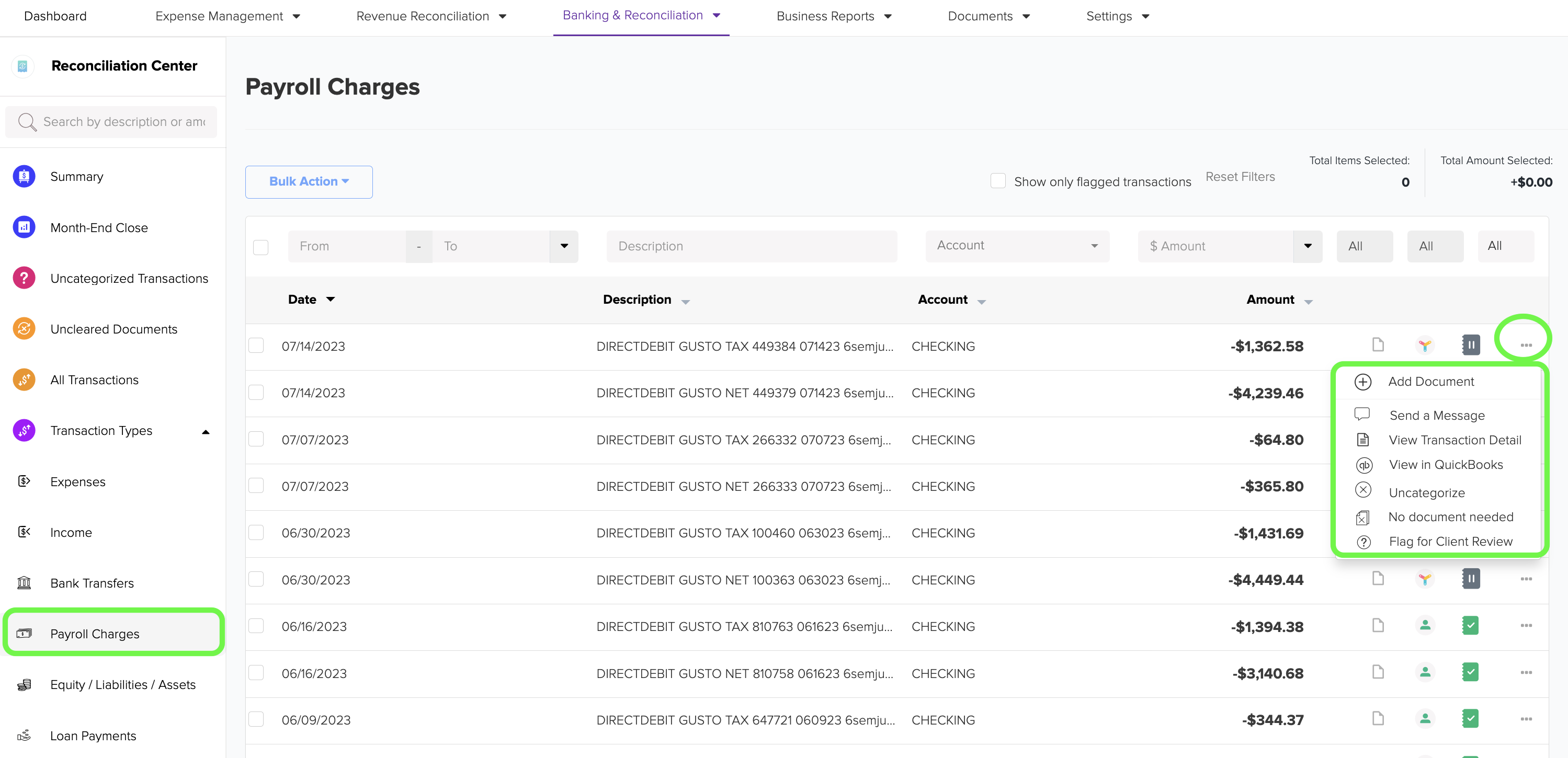

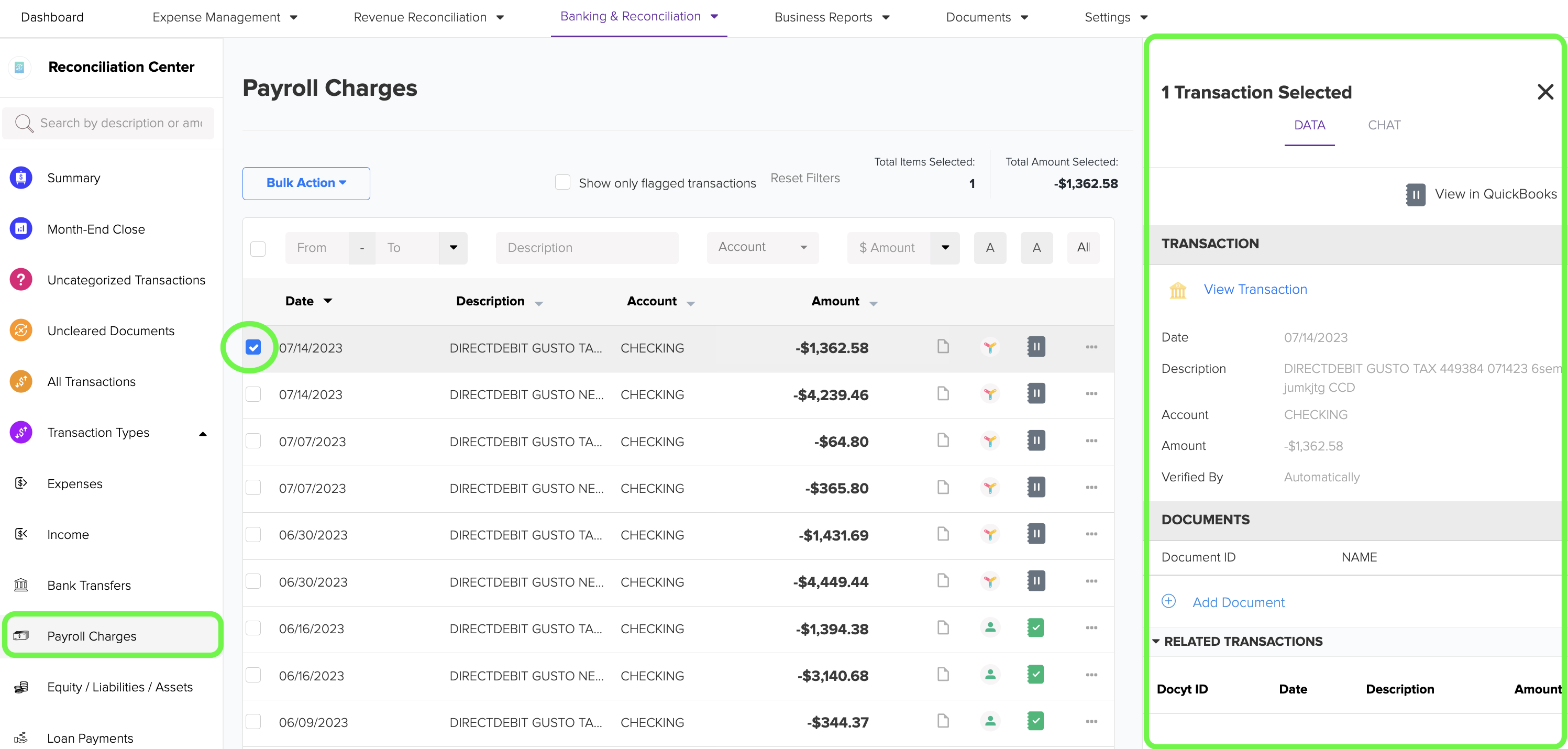

14. Payroll Charges: This category encompasses all bank transactions associated with payroll, such as wage payments and payroll taxes. You can access these transactions by clicking on the 'Payroll Charges' menu option.

15. To access additional options for a payroll charges transaction, click on the ellipsis menu. From there, you can explore various other options for the transaction. If you choose to 'Uncategorize' the transaction, it will be returned to the list of 'Uncategorized Transactions'.

16. By clicking on the checkbox of any transaction, you will see a new section on the right side. In this section, you will find helpful links that allow you to quickly access QuickBooks and view the specific details of the payroll charges transaction.

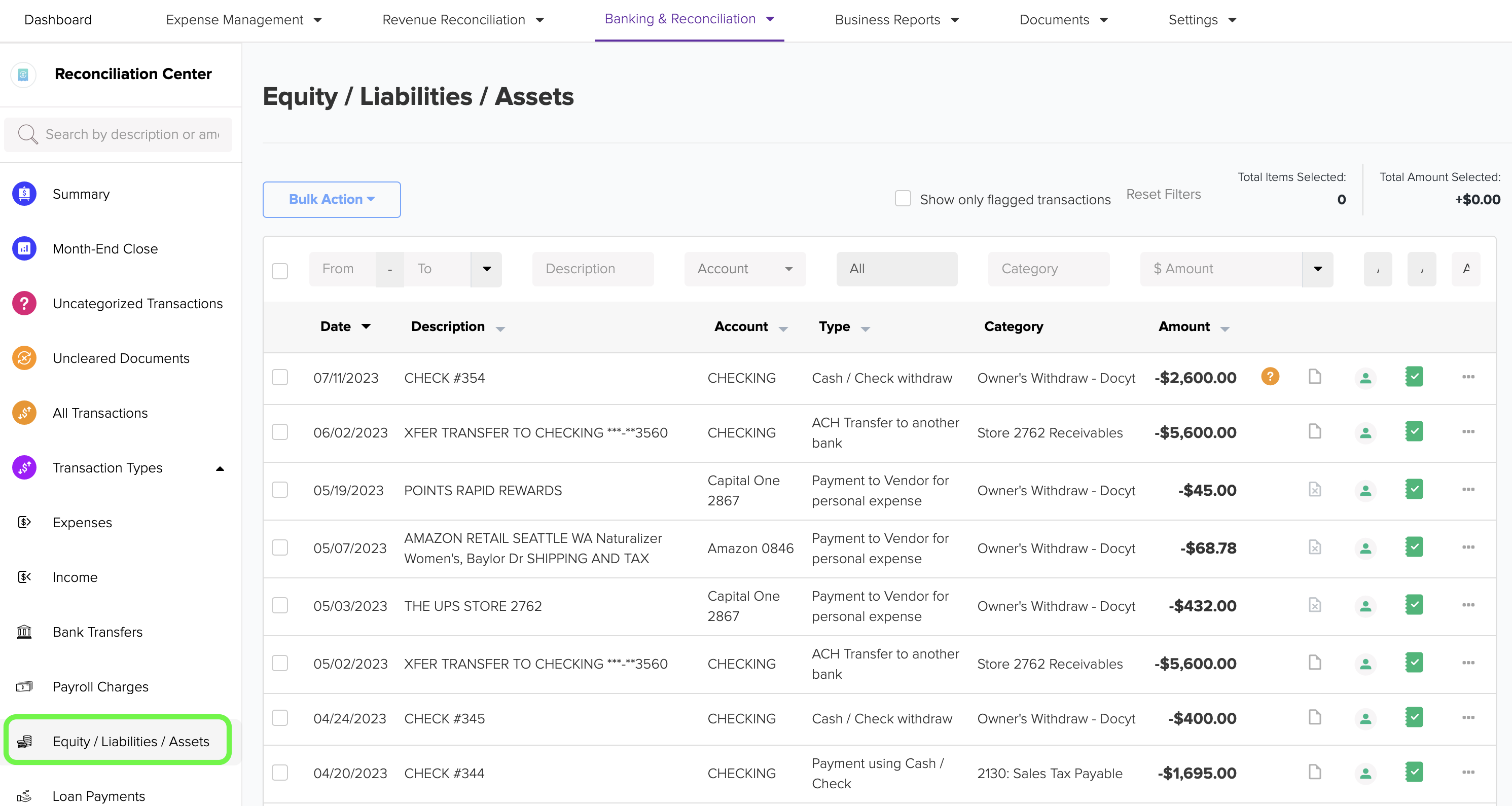

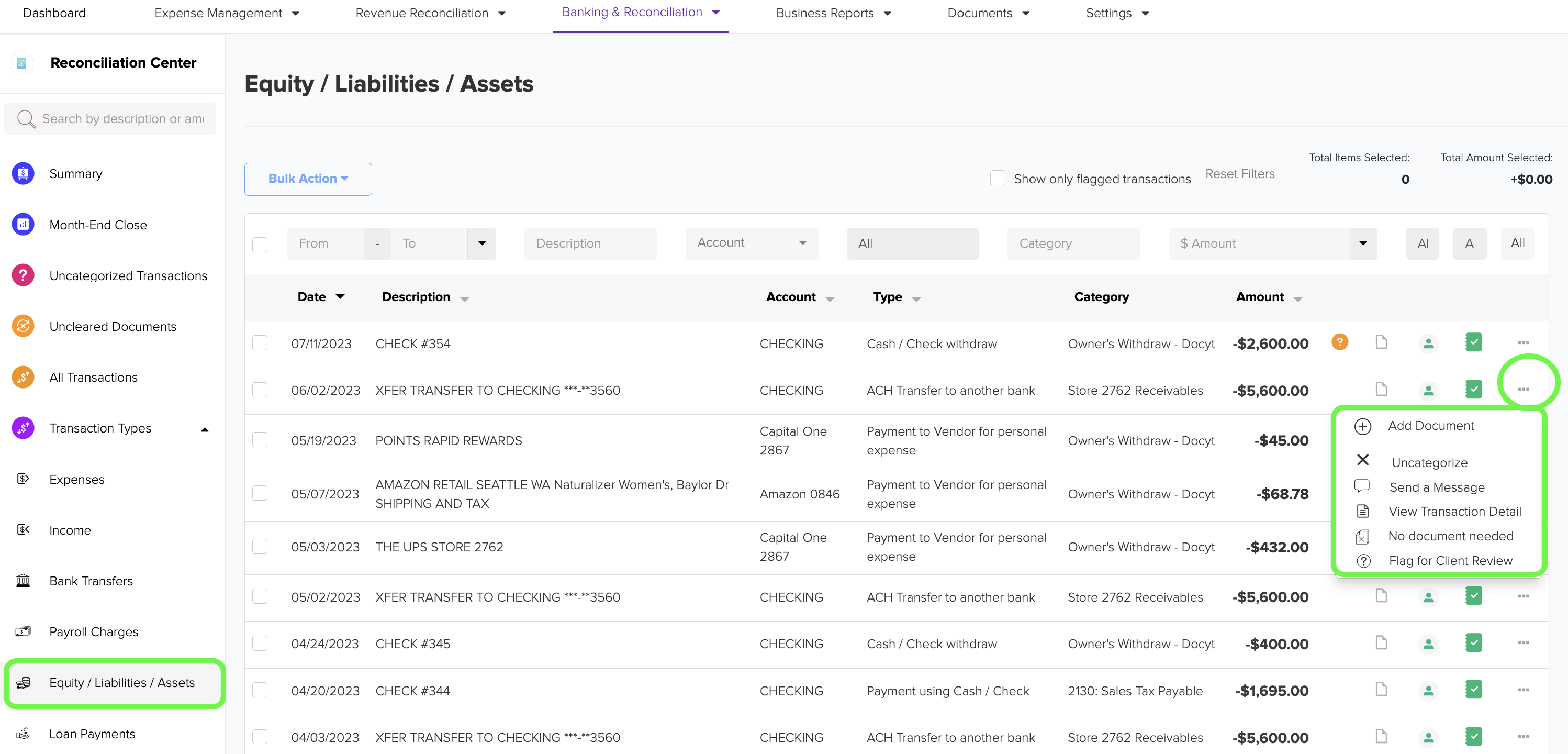

17. Equity/Liabilities/Assets: This category includes transactions related to equity investment, equity withdrawal, liability payments, and payments associated with assets. Click the 'Equity/Liabilities/Assets' menu to access these transactions.

18. Click on the ellipsis menu to explore additional options for an equity/liabilities/assets transaction. From there, you can discover various other choices for the transaction. If you choose to remove the categorization, the transaction will be returned to the list of 'Uncategorized Transactions'.

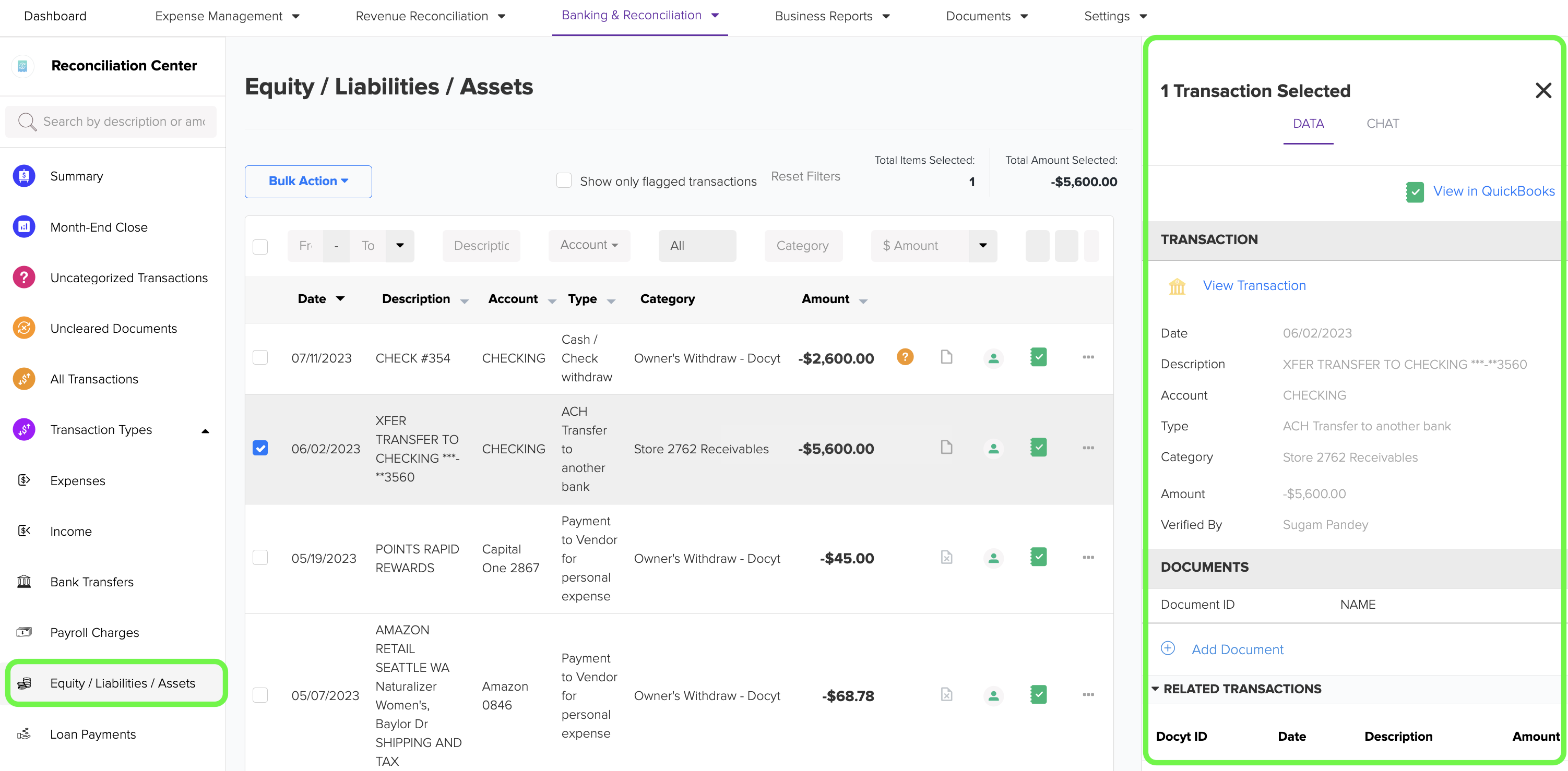

19. By clicking on the checkbox of any transaction, a new section will appear on the right side. This section provides convenient links allowing you to access QuickBooks directly and quickly view the transaction details of the equity/liabilities/assets.

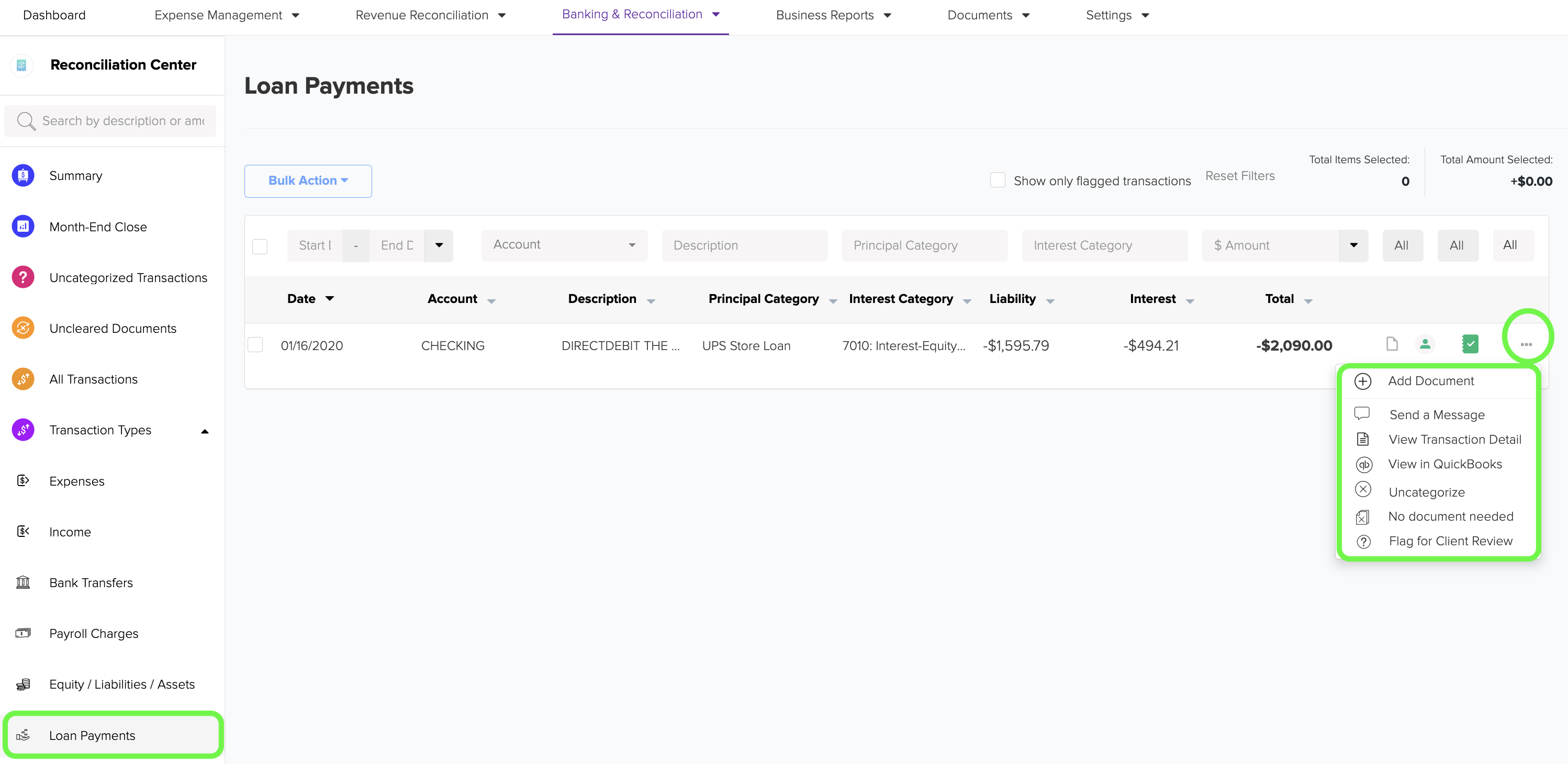

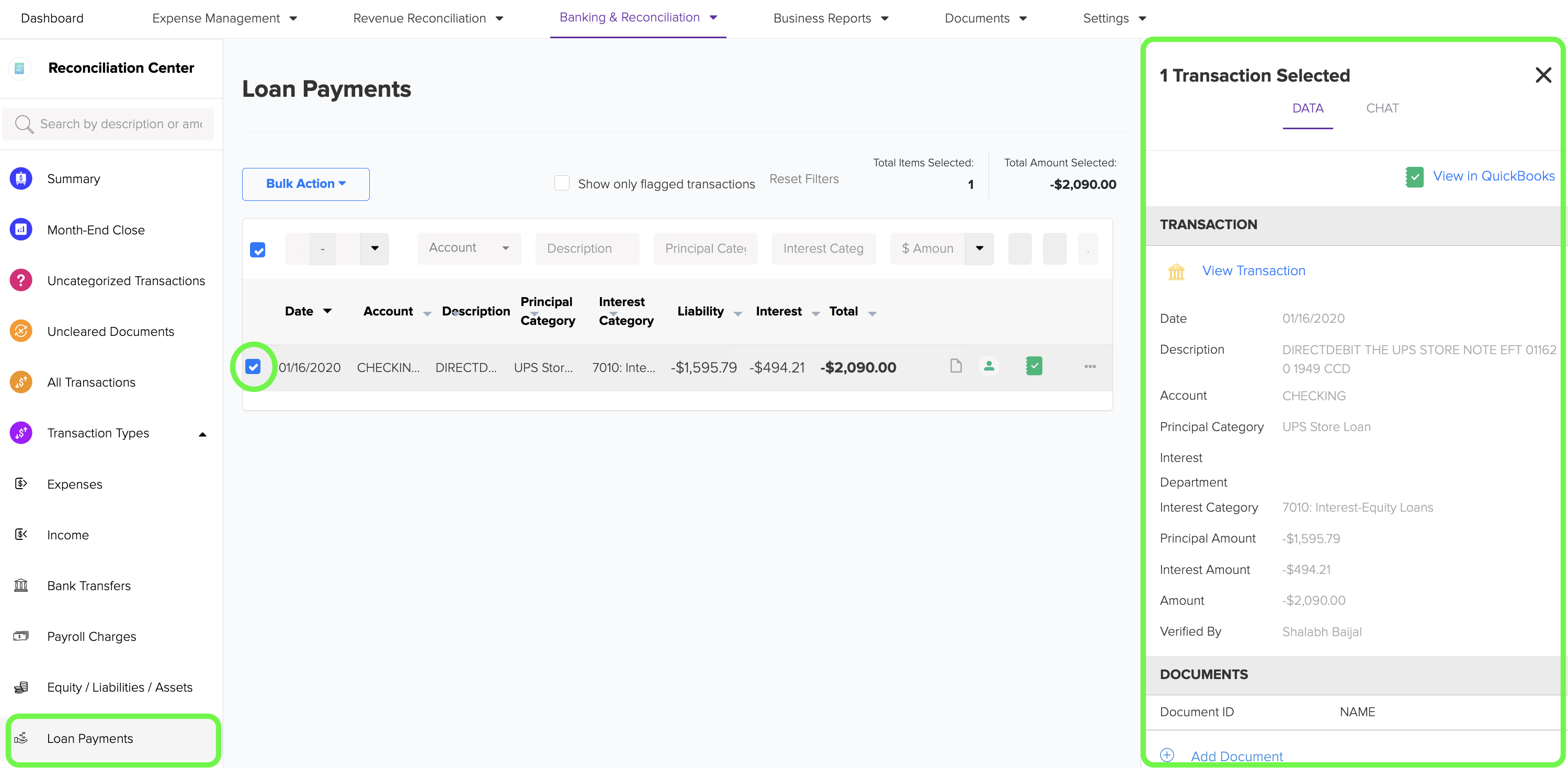

20. Loan Payments: These transactions include any payments made towards the principal and interest of loans. You can access these transactions by clicking on the 'Loan Payments' menu option.

21. Click on the ellipsis menu to access various other options for the loan payment transaction. If you choose the 'Uncategorize' option, the transaction will be returned to the list of 'Uncategorized Transactions'.

22. When you click on the checkbox of any transaction, a new section will appear on the right side. In this section, you will find convenient links that enable you to directly access QuickBooks and quickly view the specific details of the loan payments transaction.

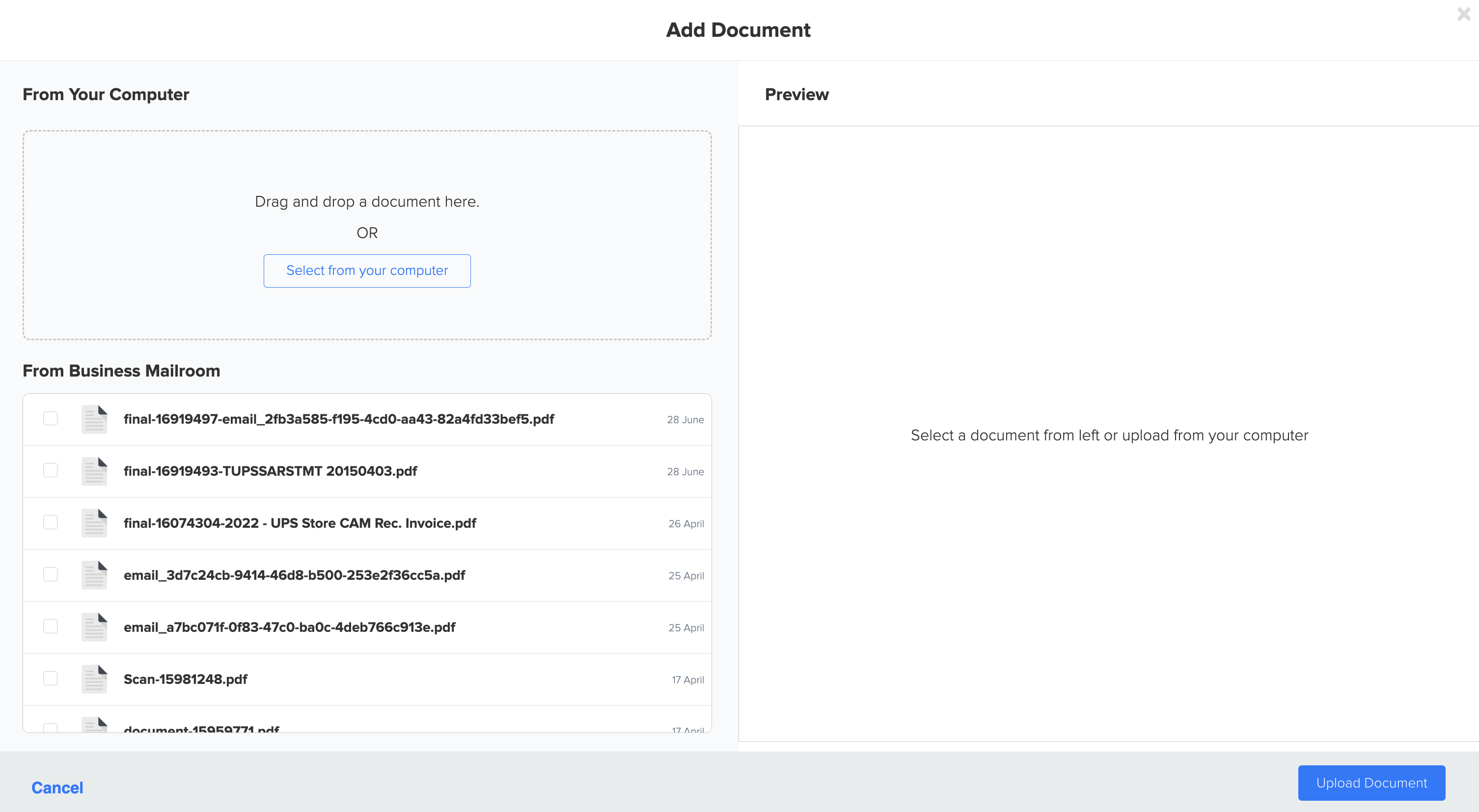

23. For transactions that are not expenses, such as when you deposit or withdraw owner equity, you also have the option to attach documents from the Business Mailroom to the transaction in the Reconciliation Center. This allows you to easily associate relevant documents with the transaction for future reference and record-keeping purposes.

24. In the details panel on the right side, you can select 'Add Document' to attach supporting documents from the Business Mailroom or your computer. This feature allows you to easily associate relevant documents with the transaction for future reference and record-keeping purposes.