Content:

- Introduction

- Procedure

- Creating Payroll Journal Entry In Docyt

- Categorizing Payroll Liability Transaction

- Automatic Categorization

Introduction

Introduction

Payroll is a bookkeeping function because it involves tracking and recording all the financial transactions related to employee compensation, including salaries, wages, bonuses, and deductions. The payroll process also involves calculating and withholding taxes, making contributions to retirement and healthcare plans, and issuing paychecks or direct deposits.

Procedure

Procedure

To book payroll, first download the Payroll Report from Online Payroll sites if applicable like ADP, Gusto, Quick Books Payroll, or as provided by the client.

Sometimes payroll report is provided by the client in the form of a document, either in the Mailroom or Unique mail ID.

Below are some major data fields that will be present in almost every type of payroll report are as follows:

-

Check Date: It is the date of booking the payroll.

-

Name: It shows all the employee's name.

-

Hours: It represent the working hours of an employee.

-

Total Paid: In simple words, it is the gross salary of an employee. It includes Net pay + Tax Withheld + Deductions.

-

Tax Withheld: Tax withheld is the amount of money that is taken out of an employee's paycheck by their employer to satisfy the employee's tax obligation to the government. This tax is typically withheld on a federal and state level and is based on the employee's earnings, tax filing status, and number of exemptions claimed.

-

Deductions: These are the employee’s contribution towards the tax liability.

-

Net Pay: It is the amount that is actually credited to the employee's account. This amount is calculated after all the deductions.

Net salary = Total Paid-Tax withheld-Deduction -

Check No.: Check number is the number mentioned on the salary check.

-

Employer liability: Employer liability in payroll refers to the taxes that employers are responsible for paying on behalf of their employees. These taxes are separate from the taxes that employees themselves pay out of their paychecks and are often paid directly by the employer to the government.

-

Total expense: Total expenses in payroll refer to the total cost incurred by an employer to compensate their employees for their work, including salary or wages, benefits, and payroll taxes. This is the amount of money that an employer spends on their workforce over a given period, such as a week, month, or year.

Total Expense (Payroll Liability)= Total Paid + Employer Liability

A. Creating Payroll Journal Entry in Docyt:

Step 1: Click on Banking & Reconcilliation > Reconcilliation Center > Journal Entries in Docyt.

Step 2: Add the Payroll Journal entry in Docyt by selecting the appropriate chart of accounts, and departments as Debits and taking Payroll Liability-Docyt as Credit. Add as many rows required in the entry.

Step 3: Click the Add Attachments to add any attachments and click the Add button to save the journal entry.

B. Categorizing Payroll Liability Transactions in Docyt:

Step 1: Click on the identified transaction.

Step 2: Select the transaction type as Payroll Charges as shown in Fig. 3. Docyt will auto-fill the category as Payroll Liability - Docyt.

Step 3: Click on the Categorize Transaction button.

Automatic Categorization of Payroll Transactions in Docyt

1. Additionally, the Docyt AI has the capability to learn and recognize how payroll transactions are categorized during the initial process. As a result, it will automatically categorize future payroll transactions, making the overall categorization process more efficient and streamlined.

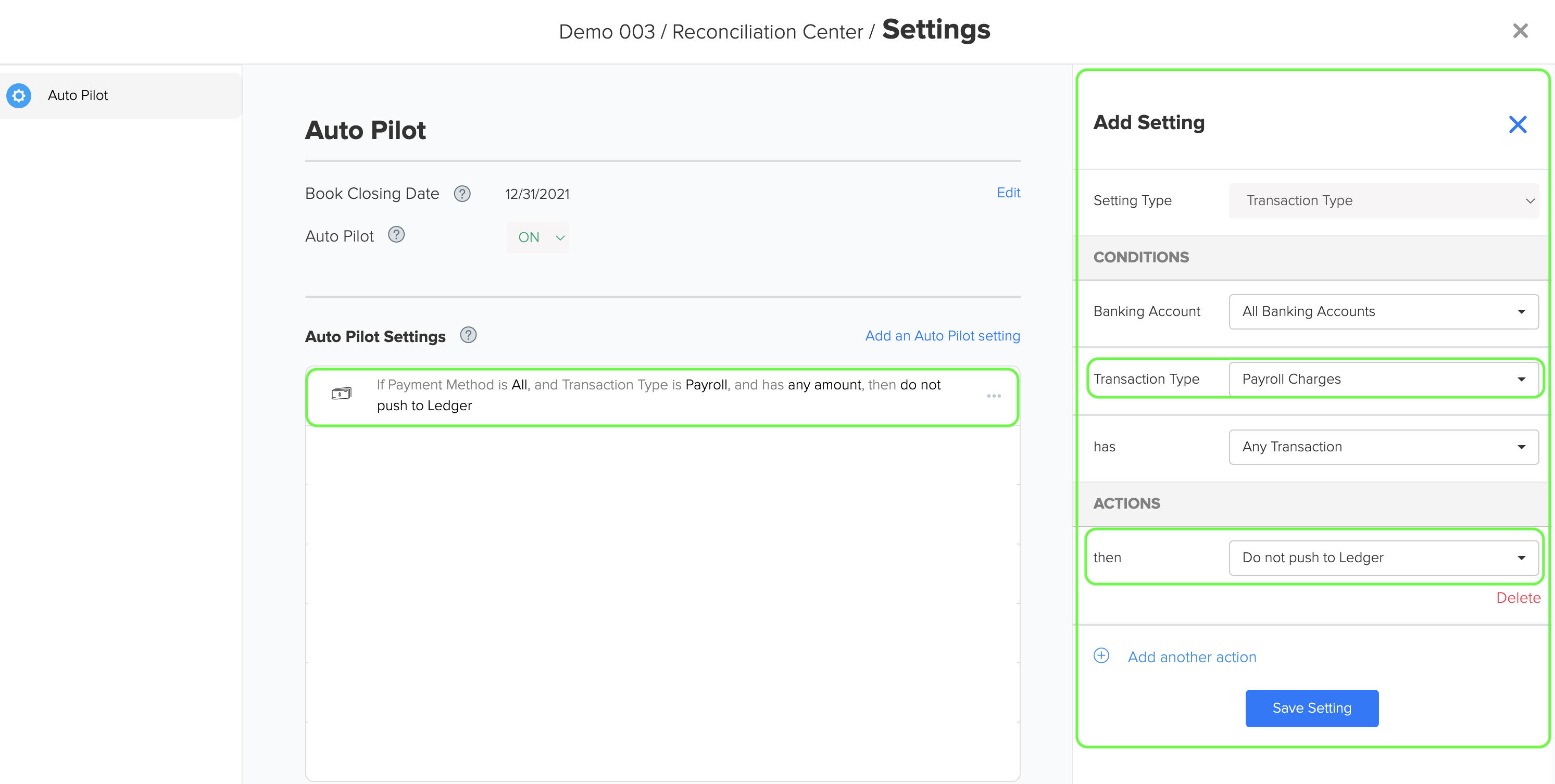

2. If your online payroll services are already connected to QBO (for example, Gusto or QuickBooks Payroll), the accounting team should enable the autopilot setting. This involves defining a condition where, if the transaction type is 'Payroll Charges', the action should be set to 'Do not Push to Ledger'. This setting is important to avoid any duplicate entries in QBO. An example explaining this is provided in the attached screenshot.

WARNING: If the business requires Docyt to push payroll transactions to the ledger, do not enable ' Do not push to Ledger' setting in Auto Pilot.