UPS® Cash Flow Report

Table of Contents

- Accessing the Report

- Export the Report as Excel or PDF

- Report Content Breakdown

- Advantages of the Report

- Troubleshooting Inaccurate Data

Accessing the Report

- You can log in to your Docyt account.

- To access the report, go to the top navigation menu and click 'Business Reports' from the drop-down menu. Then, select 'Management Reports' in the subsequent menu.

- On the Management Reports page, locate and click the 'Cash Flow Report' option to access the report.

- You can customize the report by selecting the desired period.

- Generate the report and review the detailed results to gain valuable insights into cash flows.

Limited Access: This report is exclusively available for select Docyt Plans. If you don't have access, please contact support@docyt.com for help.

To export your report to Excel or PDF format

To download your report in Excel or PDF format:

- Generate the report in Docyt.

- Click the three-dot menu icon on the top right. Choose 'Export as Excel' or 'Export as PDF' from the drop-down.

- The report will be generated in Excel or PDF format in the 'Data Export' section of Docyt, allowing you to download the report from there.

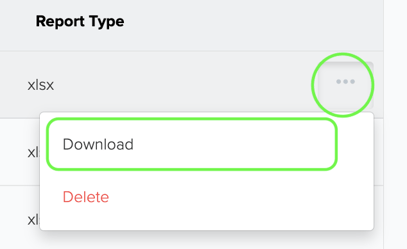

- To download the report, navigate to the 'Data Export' section by clicking the 'Data Export' link in the notification. Click the ellipsis menu on the 'Data Export' page and select the 'Download' option.

Components & Sections of the Report

Cash Flows from Operating Activities: This section highlights the cash flow generated or utilized from the day-to-day operations of your business.

-

Net Income: Discover the net income earned during the reporting period, which reflects the overall profitability of your business.

-

Adjustments to Reconcile Net Income to Cash Provided by (Used In) Operating Activities: You can explore the adjustments made to align net income with the actual cash generated or utilized by your business operations.

-

Decrease (Increase) in Accounts Receivable: Understand the changes in accounts receivable, which represent the amounts owed to your business by customers.

-

Decrease (Increase) in Other Current Assets: Learn about the fluctuations in other current assets, encompassing various short-term assets besides accounts receivable.

-

Increase (Decrease) in Accounts Payable: Analyze the changes in accounts payable, which represent the amounts your business owes to suppliers or creditors.

-

Increase (Decrease) in Other Current Liabilities: Evaluate the changes in other current liabilities, encompassing various short-term liabilities besides accounts payable.

-

Net Cash Provided By (Used In) Operating Activities: Discover the net cash flow from your business's day-to-day operations.

Cash Flows from Investing Activities: This section accounts for cash transactions related to investments in long-term assets. For a UPS store, investing activities might include:

-

-

- Purchase or sale of property, plant, and equipment (e.g., vehicles, computers).

- Investments in other businesses.

- Proceeds from the sale of investments.

-

Cash Flows from Financing Activities: This section focuses on the cash flow generated or utilized from financing-related activities.

-

Increase (Decrease) in Other Equity: Explore changes in other equity, which represents the changes in equity not attributable to net income or dividends.

-

Net Cash Provided By (Used In) Financing Activities: Understand the net cash flow from financing activities.

-

Cash and Temporary Cash Investments, Beginning of Period: Learn the starting balance of cash and temporary cash investments at the beginning of the reporting period.

-

Increase (Decrease) in Cash and Temporary Cash Investments: Evaluate the changes in cash and temporary cash investments during the reporting period.

-

Cash and Temporary Cash Investments, End of Period: Discover the closing balance of cash and temporary cash investments at the end of the reporting period.

By understanding and utilizing the information presented in the Cash Flow Report, you can effectively manage and optimize the cash flow of your UPS Store.

Benefits

-

Clear Financial Visibility: The Cash Flow Report provides a clear and concise snapshot of your business's cash flow, enabling you to understand the inflows and outflows of cash quickly.

-

Proactive Decision-Making: With the insights gained from the report, you can make bold and informed financial decisions, ensuring the efficient allocation of resources and the ability to seize new opportunities.

What To Do If Your Report Data Is Not Accurate

For inaccurate data:

- Consult with your Docyt Account Manager for guidance and resolution.

- For general support questions, please email Docyt support at support@docyt.com for help troubleshooting and resolving discrepancies.