Hospitality Payroll-Related Expenses Report (Schedule 14)

Table of Contents

- Accessing the Report

- Report Customization

- Excel or PDF Format Export

- Report Content Breakdown

- Advantages of the Report

- Sample Report

- Troubleshooting Inaccurate Data

Accessing the Report

- Log in to your Docyt account.

- From the top navigation menu, select 'Business Reports' from the drop-down menu. In the subsequent menu, choose 'Departmental Reports'.

- On the Departmental Reports page, locate and click the 'Schedule 14 - Payroll-Related Expenses' option to access the report.

%20_%20Step%202.png?width=688&height=462&name=Hospitality%20Payroll-Related%20Expenses%20Report%20(Schedule%2014)%20_%20Step%202.png)

- You can customize the report parameters by selecting the desired period and column views.

%20_%20Step%204.png?width=688&height=469&name=Hospitality%20Payroll-Related%20Expenses%20Report%20(Schedule%2014)%20_%20Step%204.png)

- Incorporate Budget columns into your reports. Click here to learn more.

- Generate the report and review the detailed results to gain valuable insights into revenue performance and financial accuracy.

Limited Access: This report is exclusively available for select Docyt Plans. If you don't have access, please contact support@docyt.com for help.

Report Customization

Use the dropdown menu in business reports to filter based on the following selections:

- Percentage Column

- Last Year

- Per Available Room (PAR)

- Per Occupied Room (POR)

- Budget

To export your report to Excel or PDF format

- Generate and review the desired report in Docyt.

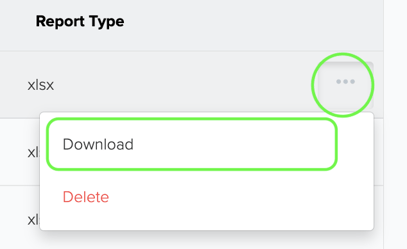

- To export your report to Excel or PDF format, go to the top right corner of the report page and find the three-dots menu icon (...). Click on the three dots to reveal the menu options, and from there, select 'Export as Excel' or 'Export as PDF'.

%20_%20Step%205.png?width=688&height=469&name=Hospitality%20Payroll-Related%20Expenses%20Report%20(Schedule%2014)%20_%20Step%205.png)

- A notification will appear, indicating that the report can be downloaded from the 'Data Export' section of Docyt.

- To download the report, navigate to the 'Data Export' section by clicking the 'Data Export' link in the notification. Click the ellipsis menu on the 'Data Export' page and select the 'Download' option.

Components and Sections of the Report

This report focuses on the following key components:

-

Payroll Taxes: Evaluate different types of payroll taxes, including national disability insurance, national medical insurance, retirement contributions, unemployment insurance, state disability insurance, and more.

-

Supplemental Pay: Analyze various forms of extra pay, such as personal days, severance pay, sick pay, holiday pay, vacation/paid time off, and other additional compensation.

-

Employee Benefits: Evaluate various employee benefits, including health insurance, dental insurance, contributory savings plans, group life insurance, stock benefits, and more.

The report consists of the following sections:

-

Payroll Taxes: Detailed breakdown of payroll taxes, providing insights into the financial impact of various tax obligations.

-

Supplemental Pay: Analysis of extra pay expenses, enabling you to understand the additional compensation provided to employees.

-

Employee Benefits: Examination of the costs associated with employee benefits, ensuring comprehensive financial management.

-

Total Payroll-Related Expenses: Calculate the total expenses related to payroll and associated obligations.

Sample Report

%20_%20Step%203.png?width=688&height=469&name=Hospitality%20Payroll-Related%20Expenses%20Report%20(Schedule%2014)%20_%20Step%203.png)

What To Do If Your Report Data Is Not Accurate

For inaccurate data:

- Consult with your Docyt Account Manager for guidance and resolution.

- For general support questions, please email Docyt support at support@docyt.com for help troubleshooting and resolving discrepancies.

Benefits

By utilizing Docyt's Hospitality Departmental Report Schedule 14, you can enjoy the following benefits:

-

Financial Control: Gain insights into payroll-related expenses to manage costs and effectively ensure compliance with payroll regulations.

-

Compliance Assurance: Stay up-to-date with payroll tax obligations and employee benefits, ensuring compliance with legal requirements.

-

Decision-making Support: Make informed decisions about payroll management and compensation packages based on accurate financial information.

Hospitality Brands that Trust Docyt

Docyt is a Hospitality and Lodging Industry Partner

We greatly appreciate your feedback!

👍 Vote for helpfulness! Your feedback matters. Let us know if our articles are helpful to you. Your vote counts!