Cash Flow Statement in Docyt

Table of Contents

- Accessing the Cash Flow Statement

- Excel or PDF File Download

- Components and Sections of the Cash Flow Statement

- Benefits

- Troubleshooting Inaccurate Data

Accessing the Cash Flow Statement

- To access the Cash Flow Statement, you must log in to your Docyt account.

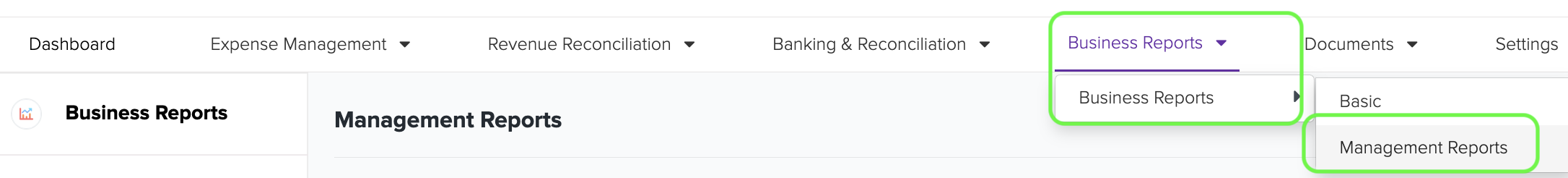

- From the top navigation menu, select 'Business Reports' from the drop-down menu.

- In the subsequent menu, choose 'Management Reports'.

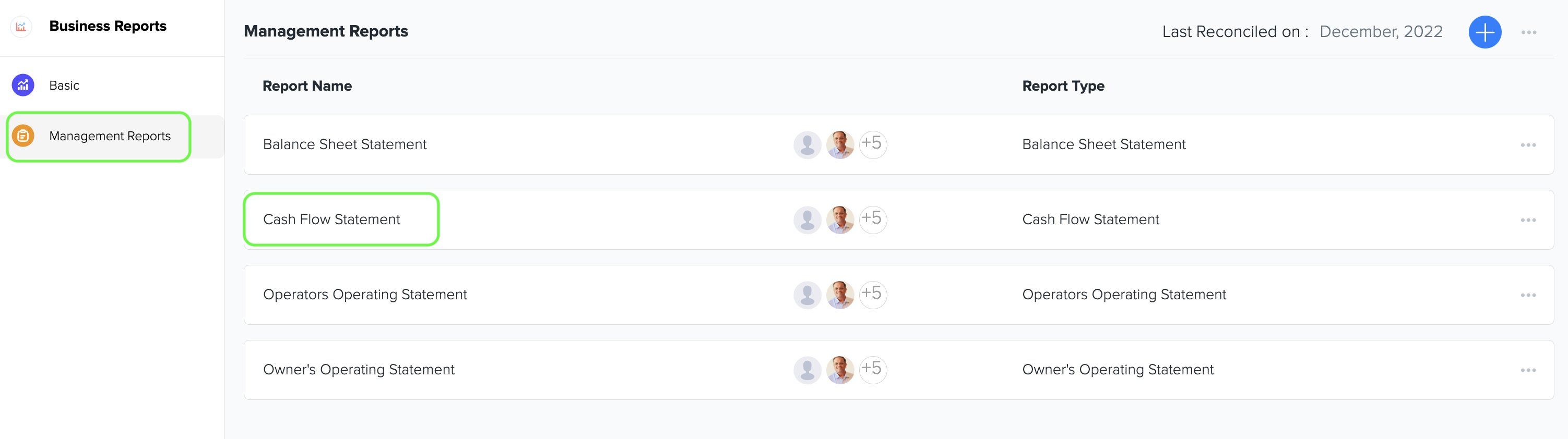

- On the Management Reports page, locate and click the 'Cash Flow Statement' option to access the report.

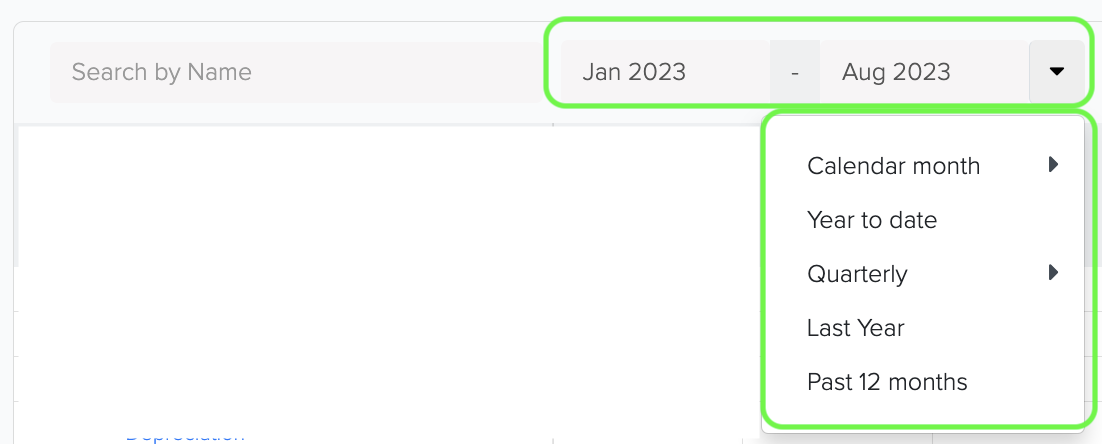

- You can choose the specific period to analyze to tailor the statement to your needs.

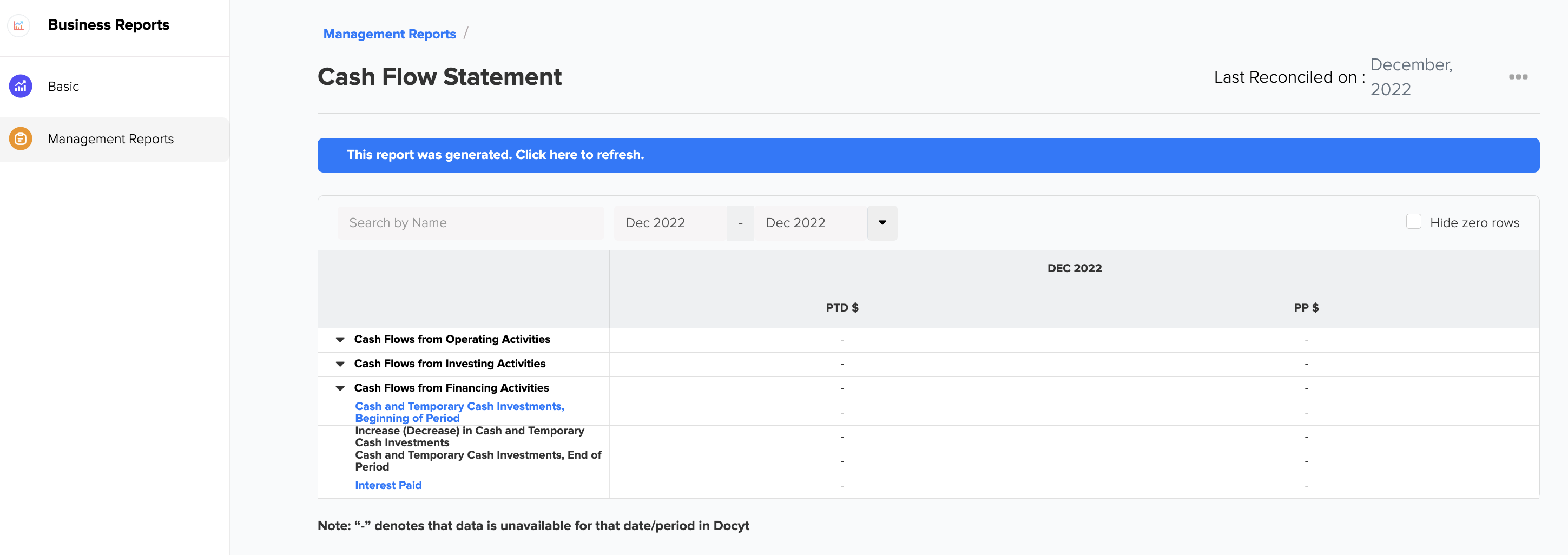

- Generate the cash flow statement and carefully analyze the detailed results to obtain valuable insights into the performance of your revenue and the accuracy of your financial information.

Limited Access: This report is exclusively available for select Docyt Plans. If you don't have access, please contact support@docyt.com for help.

Excel or PDF File Download

- Generate and review the desired report in Docyt.

- To export your report to Excel or PDF format, go to the top right corner of the report page and find the three-dots menu icon (...). Click on the three dots to reveal the menu options, and from there, select 'Export as Excel' or 'Export as PDF'.

- A notification will appear, indicating that the report can be downloaded from the 'Data Export' section of Docyt.

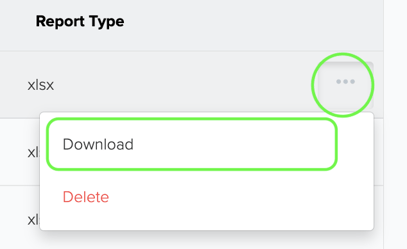

- To download the report, navigate to the 'Data Export' section by clicking the 'Data Export' link in the notification. Click the ellipsis menu on the 'Data Export' page and select the 'Download' option.

Components and Sections of the Cash Flow Statement

Cash Flows from Operating Activities: The operating activities section of the cash flow statement reports the cash flows resulting from the primary business operations of the company. It includes cash receipts from customers and cash payments to suppliers, employees, and other operating expenses. This section reflects the day-to-day activities that generate revenue for the company. Positive cash flows from operating activities indicate that the company is generating sufficient cash to sustain and grow its core operations, while negative cash flows may signal potential financial challenges.

Cash Flows from Investing Activities: The investing activities section of the cash flow statement shows cash flows related to the purchase and sale of long-term assets and investments. These activities involve significant capital expenditures and changes in investment portfolios. Cash flows from investing activities include cash inflows from the sale of assets (e.g., property, plant, equipment) and cash outflows for the purchase of new assets or investments. Companies might also report cash flows from mergers, acquisitions, or divestitures in this section. Positive cash flows from investing activities indicate that the company is making wise investment decisions, while negative cash flows may signify increased capital spending or investment activities.

Cash Flows from Financing Activities: The financing activities section of the cash flow statement highlights cash flows resulting from transactions with the company's owners and creditors. It includes activities such as issuing or repurchasing shares, issuing or redeeming debt, and payment of dividends. Companies use financing activities to raise capital and manage their capital structure. Positive cash flows from financing activities typically indicate that the company is raising funds to support its operations or growth, while negative cash flows may indicate repayment of debts or distribution of profits to shareholders.

Cash and Temporary Cash Investments, Beginning of Period: Learn the starting balance of cash and temporary cash investments at the beginning of the reporting period.

Increase (Decrease) in Cash and Temporary Cash Investments: Evaluate the changes in cash and temporary cash investments during the reporting period.

Cash and Temporary Cash Investments, End of Period: Discover the closing balance of cash and temporary cash investments at the end of the reporting period.

Benefits of the Cash Flow Statement

Understanding the cash flow statement is essential for gaining a comprehensive understanding of a company's financial performance, along with the income statement and balance sheet.

Clear Financial Visibility: The cash flow statement provides a concise and transparent overview of your business's cash flow, allowing you to easily comprehend the inflows and outflows of cash.

Proactive Decision-Making: By leveraging the insights provided by the cash flow statement, you can make proactive and well-informed financial decisions. This enables you to efficiently allocate resources and take advantage of new opportunities.

How to Address Inaccurate Cash Flow Statement Data

If you encounter inaccurate data on your cash flow statement, there are steps you can take to address the issue.

First, it is recommended that you consult with your Docyt Account Manager, who can help with any discrepancies.

Also, if you have general support questions, contact Docyt support at support@docyt.com for help troubleshooting and resolving the inaccuracies in your statement.