Balance Sheet in Docyt

Table of Contents

- Accessing the Balance Sheet

- Excel or PDF File Download

- Components and Sections of the Balance Sheet

- How to Use the Variance Calculation Feature

- Benefits

- Troubleshooting Inaccurate Data

Accessing the Balance Sheet

- To access the Balance Sheet, you must log in to your Docyt account.

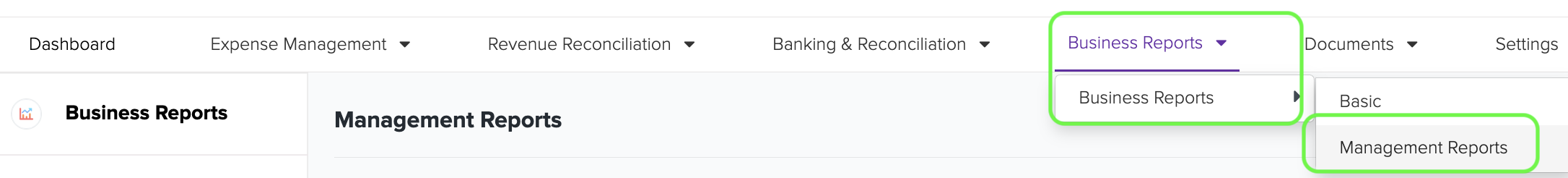

- From the top navigation menu, select 'Business Reports' from the drop-down menu.

- In the subsequent menu, choose 'Management Reports'.

- On the Management Reports page, locate and click the 'Balance Sheet Statement' option to access the report.

- Choose the specific period you want to analyze to tailor the statement to your needs.

Upon selecting the desired period, you'll access a detailed report tailored to your selection. Additionally, you'll notice a "Total" column, providing an overview of your total amount as of the last day of the selected period. This ensures that the balance displayed corresponds precisely to the endpoint of your selected time frame.

- Generate the Balance Statement and thoroughly examine the comprehensive results to gain valuable insights into your business's performance.

Limited Access: This report is exclusively available for select Docyt Plans. If you don't have access, please contact support@docyt.com for help.

How to Use the Variance Calculation Feature

Step 1: Access the Balance Sheet Report

- Open the balance sheet report.

- Look for the new "Customize" dropdown menu.

Step 2: Select Your Comparison Period

In the "Customize" dropdown, you will find the following options:

- Previous Period

- Last Year

Step 3: Understanding the Default Columns

When you select an option, the balance sheet report will show specific columns by default:

-

Previous Period (PP $):

- Variance: Difference between current and previous period.

- Variance %: Percentage difference between current and previous period.

-

Last Year (PTD LY $):

- PTD LY Variance: Difference between current and last year.

- PTD LY Variance %: Percentage difference between current and last year.

Step 4: Single Month Selection

When you select "Previous Period" from the "Customize" dropdown, the report will display:

- PP $: Balance as of the last date of the previous month.

- Variance: PTD $ - PP $.

- Variance %: (Variance / PP $) x 100.

When you select "Last Year," the report will display:

- PTD LY $: Balance as of the last date of the previous year.

- PTD LY Variance: PTD $ - PTD LY $.

- PTD LY Variance %: (PTD LY Variance / PTD LY $) x 100.

Step 5: Multiple Period Selections

If you select both "Previous Period" and "Last Year," the report will show:

- PTD $

- PP $

- Variance

- Variance %

- PTD LY $

- PTD LY Variance

- PTD LY Variance %

This structure applies to each selected month.

Example Calculations

- PP $ Calculation: If you select January 2024, PP $ will fetch the balance as of January 31, 2023.

- PTD LY $ Calculation: If you select January to March 2024, PTD LY $ will fetch the balance as of March 31, 2023.

Excel or PDF File Download

- Generate and review the desired report in Docyt.

- To export your report to Excel or PDF format, go to the top right corner of the report page and find the three-dots menu icon (...). Click on the three dots to reveal the menu options, and from there, select 'Export as Excel' or 'Export as PDF'.

- A notification will appear, indicating that the report can be downloaded from the 'Data Export' section of Docyt.

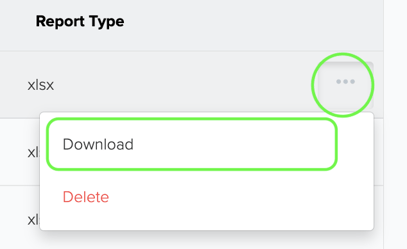

- To download the report, navigate to the 'Data Export' section by clicking the 'Data Export' link in the notification. Click the ellipsis menu on the 'Data Export' page and select the 'Download' option.

Components and Sections of the Balance Sheet

A balance sheet consists of several line items representing different categories of assets, liabilities, and shareholders' equity. The line items can vary depending on the company's industry, size, and accounting practices. A general explanation of common line items you might find on a balance sheet is as follows:

Assets:

-

Current Assets:

- Cash and Cash Equivalents: Actual cash on hand and short-term investments that can be quickly converted to cash.

- Accounts Receivable: Amounts owed to the company by customers for goods or services sold on credit.

- Inventory: Value of goods held by the company for resale or production.

- Prepaid Expenses: Payments made in advance for expenses like rent, insurance, or services yet to be consumed.

-

Non-Current Assets (Long-Term Assets):

- Property, Plant, and Equipment (PP&E): Physical assets such as land, buildings, machinery, and vehicles.

- Intangible Assets: Non-physical assets with value, like patents, trademarks, copyrights, and goodwill.

- Investments: Long-term investments in stocks, bonds, or other securities.

- Deferred Tax Assets: Future tax benefits from past tax losses or temporary differences between book and tax values.

Liabilities:

-

Current Liabilities:

- Accounts Payable: Amounts owed by the company to suppliers for goods or services received.

- Short-Term Borrowings: Debt that needs to be repaid within a year.

- Accrued Liabilities: Expenses incurred but not yet paid, like salaries and taxes.

- Current Portion of Long-Term Debt: The portion of long-term debt due within the next year.

-

Non-Current Liabilities (Long-Term Liabilities):

- Long-Term Debt: Debt that is payable over a period exceeding one year.

- Deferred Tax Liabilities: Future tax payments resulting from temporary differences between book and tax values.

- Other Long-Term Liabilities: Other obligations like pension liabilities or deferred compensation.

Shareholders' Equity:

- Common Stock: The par value of shares issued to shareholders.

- Additional Paid-In Capital: Amounts received from shareholders in excess of the par value of common stock.

- Retained Earnings: Accumulated profits the company has retained instead of distributing as dividends.

- Treasury Stock: Shares of the company's own stock that it has repurchased.

- Accumulated Other Comprehensive Income: Gains and losses that bypass the income statement but affect equity, like foreign currency translation adjustments.

Benefits of the Balance Sheet

The balance sheet is a foundational tool for understanding a company's financial position, facilitating decision-making, and fostering trust among stakeholders. Its benefits extend to both internal management and external parties seeking accurate insights into a company's financial health.

How to Address Inaccurate Balance Sheet Data

If you encounter inaccurate data on your balance sheet statement, there are steps you can take to address the issue.

First, it is recommended that you consult with your Docyt Account Manager, who can help with any discrepancies.

Also, if you have general support questions, you can contact Docyt support at support@docyt.com for help troubleshooting and resolving your statement's inaccuracies.