What are IRS 1099-MISC, 1099-NEC, 1099-K, 1099-INT and 1099-DIV Forms

Internal Revenue Service (IRS) 1099-forms

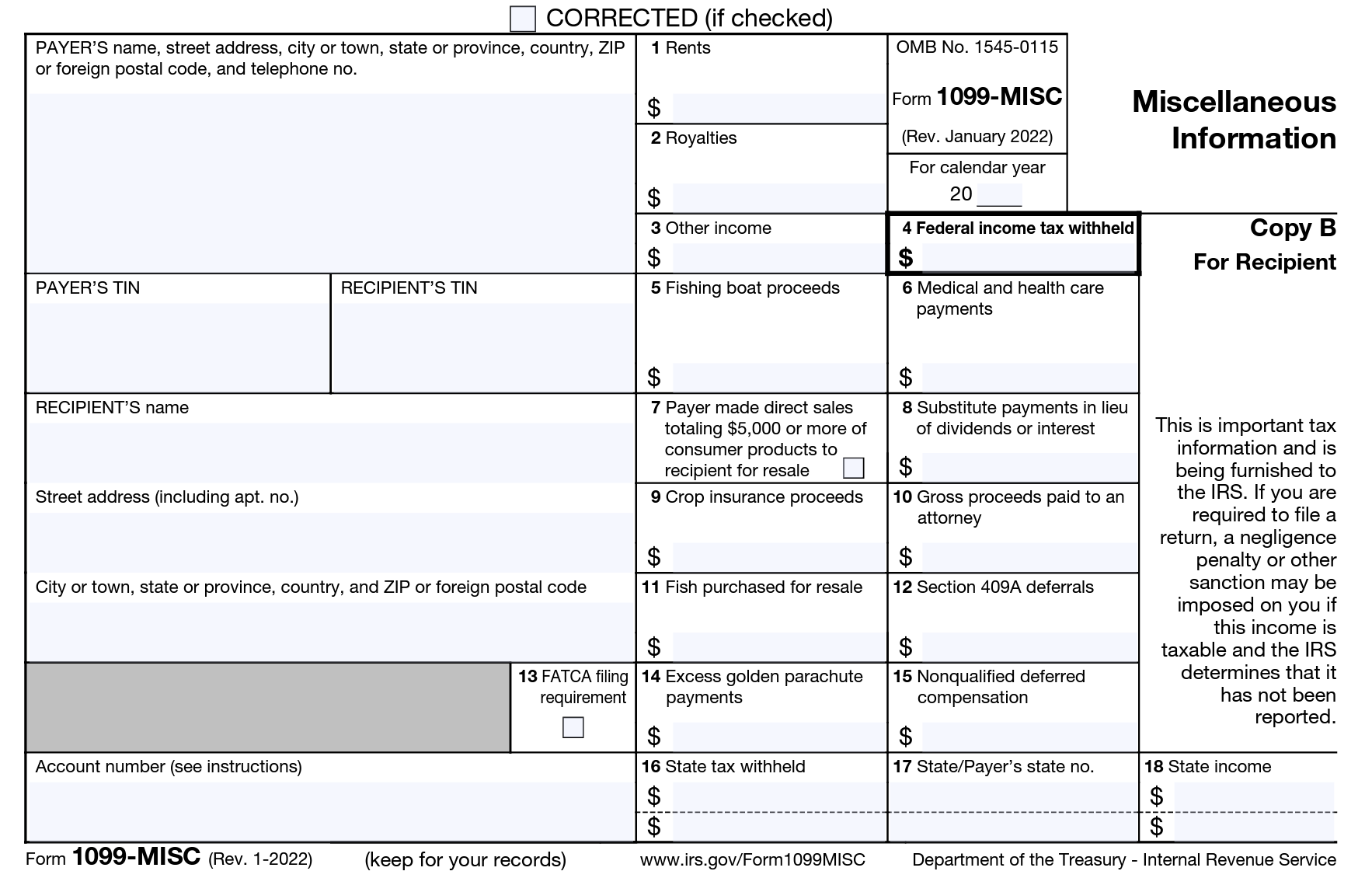

1. Form 1099-MISC (Miscellaneous Information)

Form 1099-MISC is an Internal Revenue Service (IRS) form used by businesses to report certain types of miscellaneous incomes. If a business paid more than $600 in legal settlements, rent payments, or prizes and awards, it will need to file form 1099-MISC, because these are all payments that are not subject to self-employment taxes. The due date for IRS form 1099-MISC is Feb 28, if you file by mail (on paper), and March 31 if you file electronically.

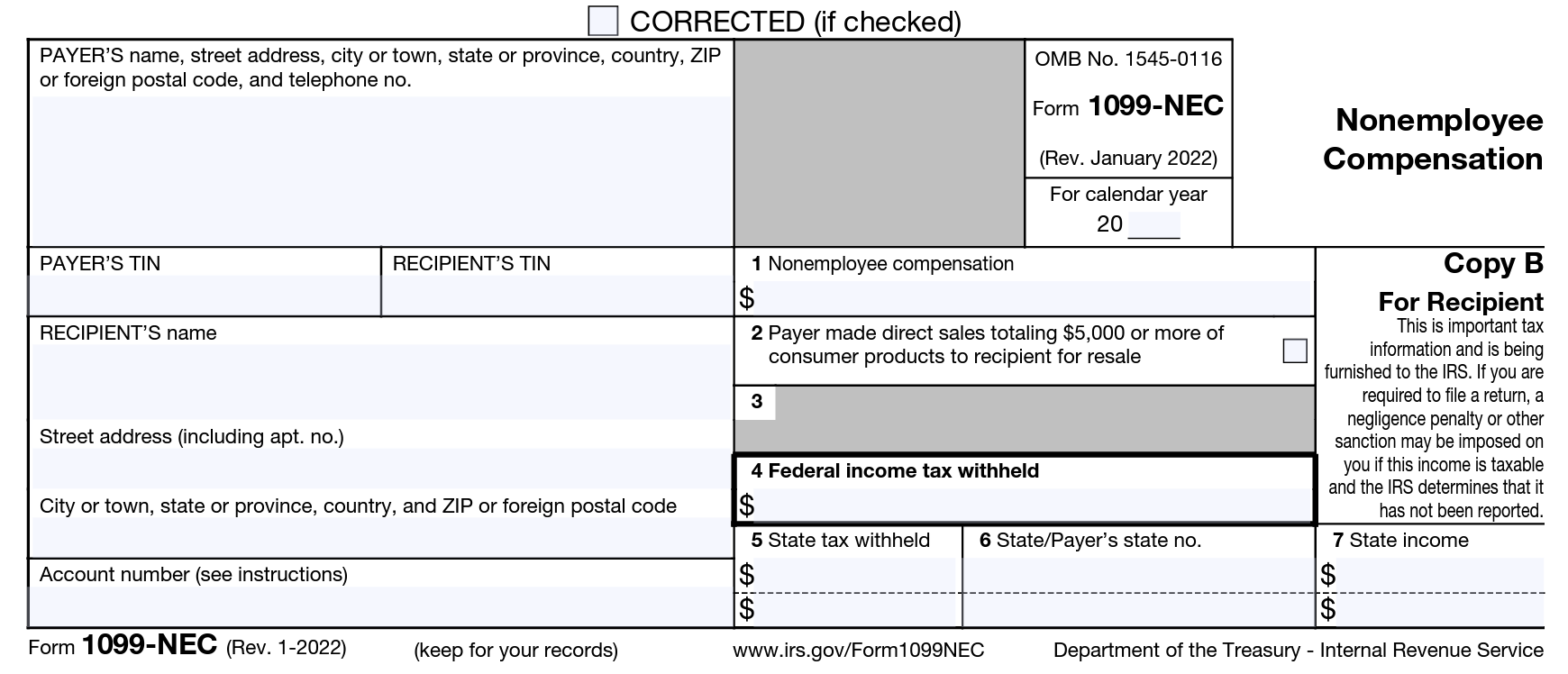

2. Form 1099-NEC (Non-Employee Compensation)

Form 1099-NEC (Non-Employee Compensation) is the IRS form used by businesses to report payments made to independent contractors, freelancers, sole proprietors, and self-employed individuals. Before year 2020, all non-employee compensation was reported on Form 1099-MISC. Form 1099-NEC is due on Jan-31st of the following tax year.

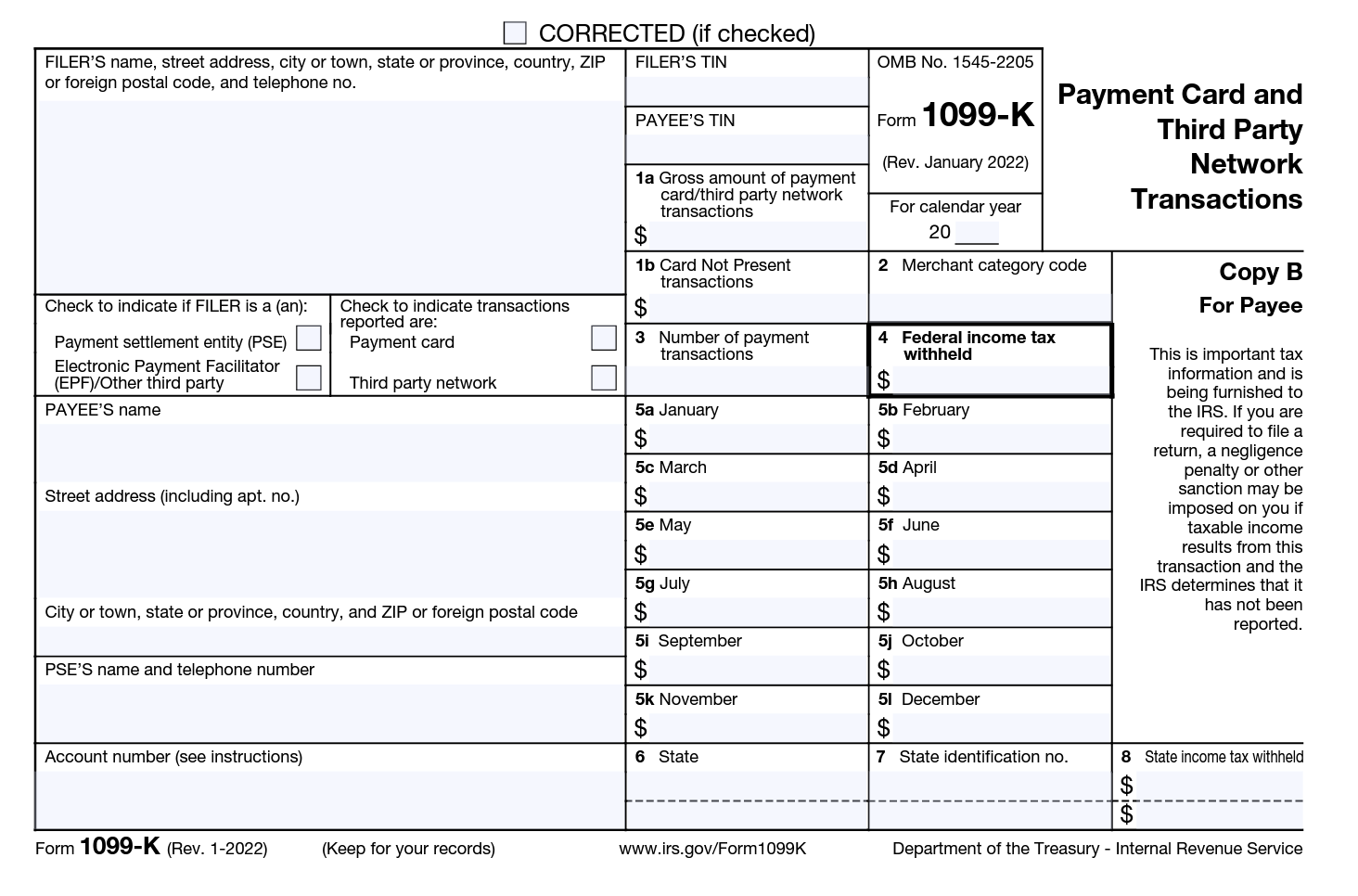

3. Form 1099-K (Payment Card and Third Party Network Transactions)

Form 1099-K is a report of payments you got during the year from:

-

Credit, debit, or stored value cards such as gift cards (Payment cards)

-

Payment apps or online marketplaces (Third-party payment networks).

Reporting threshold

Notice 2024-85 PDF issued 11/26/2024, provides guidance and clarifies that third party settlement organizations are required to report transactions for goods or services where the total payments received were more than $5,000 in 2024; more than $2,500 in 2025; and more than $600 in calendar year 2026 and thereafter.

There are no changes to what counts as income or how tax is calculated.

Although the IRS is taking a phased approach to implementing the Form 1099-K reporting threshold, companies could still send the form for over $600.

You can use Form 1099-K along with your other tax records to accurately calculate and report your taxable income when filing your taxes. Payment card companies, payment apps, and online marketplaces are also required to submit Form 1099-K to the IRS and send a copy to taxpayers by January 31st.

Gifts or reimbursement of personal expenses from friends and family should not be reported on Form 1099-K. They are not payments for goods or services.

How does Form 1099-K threshold change impact Docyt Customers?

Docyt leverages a partnership with a third party payment network Dwolla for all Docyt ACH Payments. Dwolla issues 1099-K forms for transactions within our network that exceeds federal or state reporting thresholds.

What about other payment types like Docyt Check and Self Print Check Transactions?

All Transactions using Docyt ACH, Docyt Self Print Check, or Docyt Check are captured on the 1099 report available in Docyt. View this article to learn how to create a 1099 report in Docyt.

What do I do if I or my end users received a Form 1099-K?

The Form 1099-K is an information return for both federal and state taxes. It's important to note that the gross payments reported on the Form 1099-K may not always represent your reportable income. To accurately determine your taxable income, you should use the form in conjunction with other tax records such as bank statements and invoices. It's recommended to consult with your tax advisor for assistance in determining your taxable income.

4. Form 1099-INT (Interest Income)

- Form 1099-INT is an IRS income tax form that reports interest income received by taxpayers.

- Interest-paying entities must issue Form 1099-INT to investors at year's end and include a breakdown of all types of interest income and related expenses.

- Brokerage firms, banks, mutual funds, and other financial institutions must file Form 1099-INT on interest of more than $10 paid during the year.

- Types of interest income for which Form 1099-INT is issued include interest on deposit accounts, dividends, and amounts paid to the holder of a collateralized debt obligation.

- Forms should be sent to recipients no later than Jan. 31.

5. Form 1099-DIV (Dividends and Distributions):

- Form 1099-DIV, Dividends and Distributions is sent to investors who receive distributions from any type of investment during a calendar year.

- Banks, investment companies, and other financial institutions must provide taxpayers with the form by January 31 every year.

- Taxpayers are only sent the form if the dividends and/or distributions they receive exceed $10.

- Financial institutions must send the form to both the taxpayer and to the IRS.

6. General information of 1099s i.e. what to report, amounts to report, due date (to IRS), and due date (to recipient) are as shown in Table-I.

Table-I

|

Form |

Title |

What To Report |

Amounts To Report |

Due Date (To IRS) |

Due Date (To Recipient) |

|---|---|---|---|---|---|

|

1099-NEC |

Nonemployee Compensation |

Payments for services performed for a trade or business by people not treated as its employees (including payments reported pursuant to an election described in Regulations section 1.1471-4(d)(5)(i)(A) or reported as described in Regulations section 1.1471-4(d)(2)(iii)(A)). Examples: fees to subcontractors or directors and golden parachute payments. |

$600 or more |

Jan 31 |

Jan 31 |

|

Aggregated direct sales of consumer goods for resale. |

$5,000 or more |

||||

|

1099-MISC |

Miscellaneous Information |

Rent or royalty payments; prizes and awards that are not for services, such as winnings on TV or radio shows (including payments reported pursuant to an election described in Regulations section 1.1471-4(d)(5)(i)(A) or reported as described in Regulations section 1.1471-4(d)(2)(iii)(A)). |

$600 or more, except $10 or more for royalties |

Feb 28* *The due date is March 31 if filed electronically. |

Jan 31** ** The due date is March 15 for reporting by trustees and middlemen of WHFITs (Widely held fixed investment trusts). |

|

Payments to crew members by owners or operators of fishing boats including payments of proceeds from sale of catch. |

All amounts |

||||

|

Section 409A income from nonqualified deferred compensation plans (NQDCs). |

All amounts |

||||

|

Payments to a physician, physicians' corporation, or other supplier of health and medical services. Issued mainly by medical assistance programs or health and accident insurance plans. |

$600 or more |

||||

|

Fish purchases paid in cash for resale. |

$600 or more |

||||

|

Crop insurance proceeds |

$600 or more |

||||

|

Substitute dividends and tax-exempt interest payments reportable by brokers. |

$10 or more |

February 15** ** The due date is March 15 for reporting by trustees and middlemen of WHFITs. |

|||

|

Gross proceeds paid to attorneys. |

$600 or more |

||||

|

A U.S. account for chapter 4 purposes to which you made no payments during the year that are reportable on any applicable Form 1099 (or a U.S. account to which you made payments during the year that do not reach the applicable reporting threshold for any applicable Form 1099) reported pursuant to an election described in Regulations section 1.1471-4(d)(5)(i)(A). |

All amounts (including $0) |

January 31** ** The due date is March 15 for reporting by trustees and middlemen of WHFITs. |

|||

|

Aggregated direct sales of consumer goods for resale. |

$5,000 or more |

||||

|

1099-K |

Payment Card and Third Party Network Transactions |

Payment card transactions |

All Amounts |

Feb 28* *The due date is March 31 if filed electronically |

Jan 31 |

|

Third party network transactions |

More than $5,000 in 2024; more than $2,500 in 2025; and more than $600 in calendar year 2026 and thereafter. |