Generating a 1099 Eligibility Report for Vendors in Docyt

End-of-Year 1099 eligibility reports have never been so simple

Table of Content

A. What are IRS 1099-MISC, 1099-NEC, and 1099-K Forms

B. My Vendors

C. 1099 Reports

A.What are IRS 1099-MISC, 1099-NEC, and 1099-K Forms

Click here for details.

B. My Vendors

Form 1099-NEC (Non-Employee Compensation) is used by businesses to report payments made to independent contractors, freelancers, sole proprietors, and self-employed individuals to the IRS. To generate these forms, business owners must compile a list of vendors receiving NEC payments throughout the chosen tax year. With Docyt, developing CSV reports for non-employee compensation vendors receive in any specific year is a breeze.

Here's how the process works:

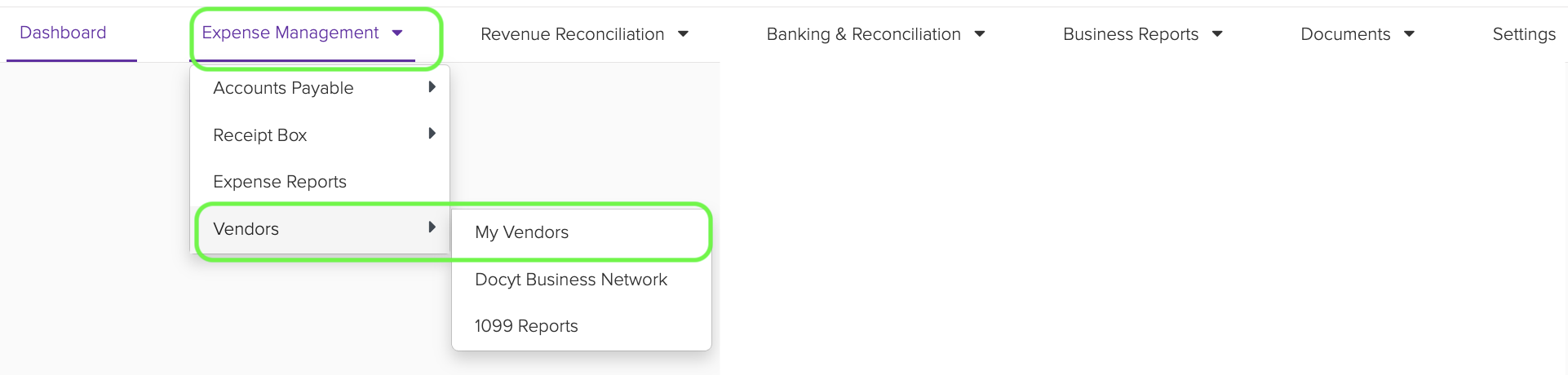

- To access the 'Vendors' section, click the 'Expense Management' drop-down menu. From there, select the 'Vendors' option and then choose 'My Vendors' from the drop-down list.

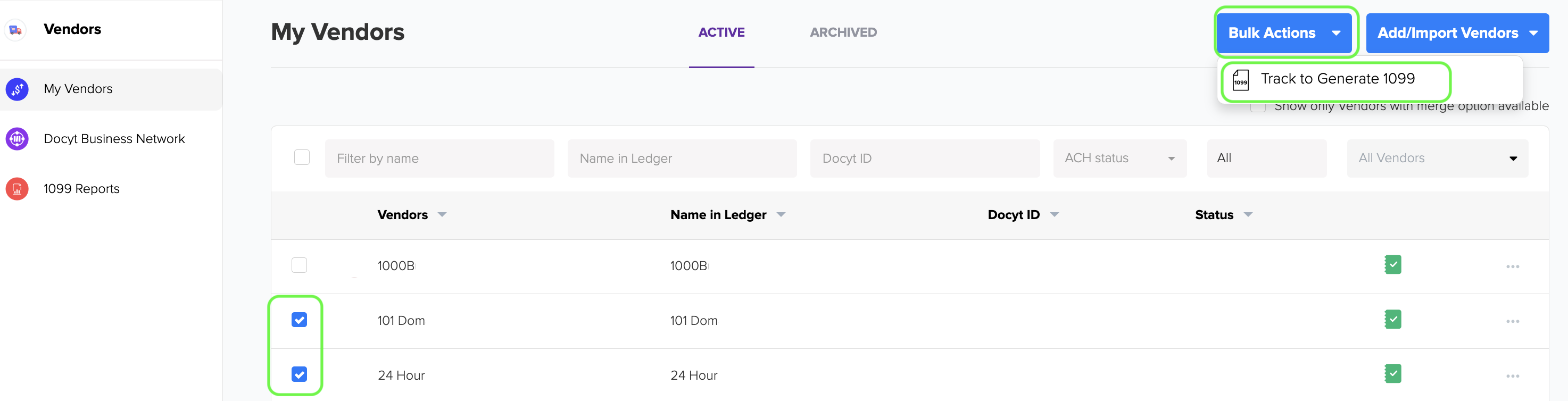

- To track vendors for generating a 1099 report for non-employee compensation, click on the checkbox in front of the vendors that need to be tracked. This will enable the blue 'Bulk Actions' button. Click on the button and select 'Track to Generate 1099'.

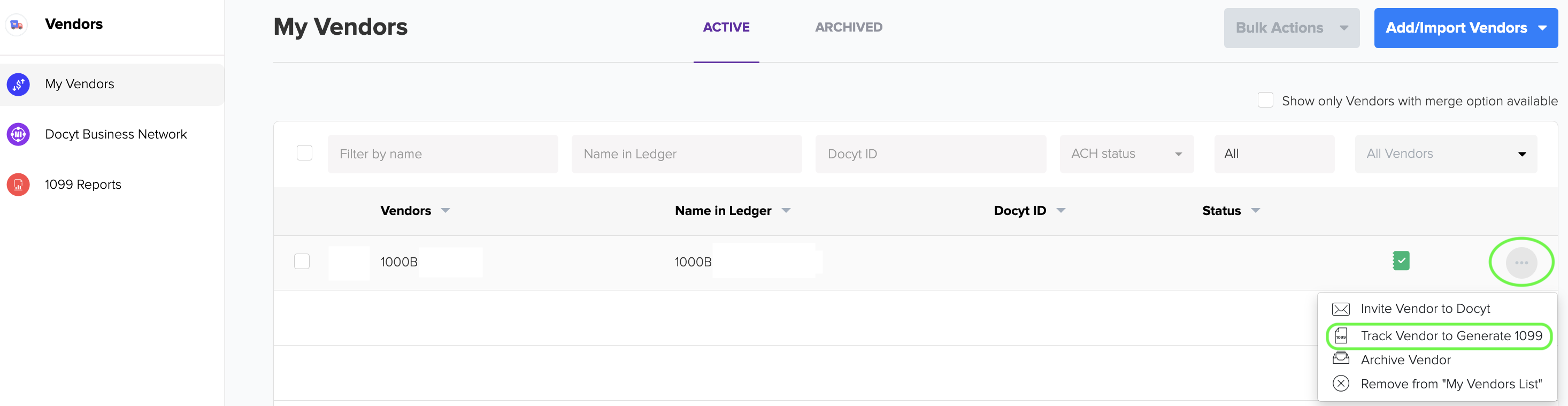

- You can also track a vendor for 1099 report generation by clicking on the ellipsis menu in the row of that vendor and selecting 'Track Vendor to Generate 1099'.

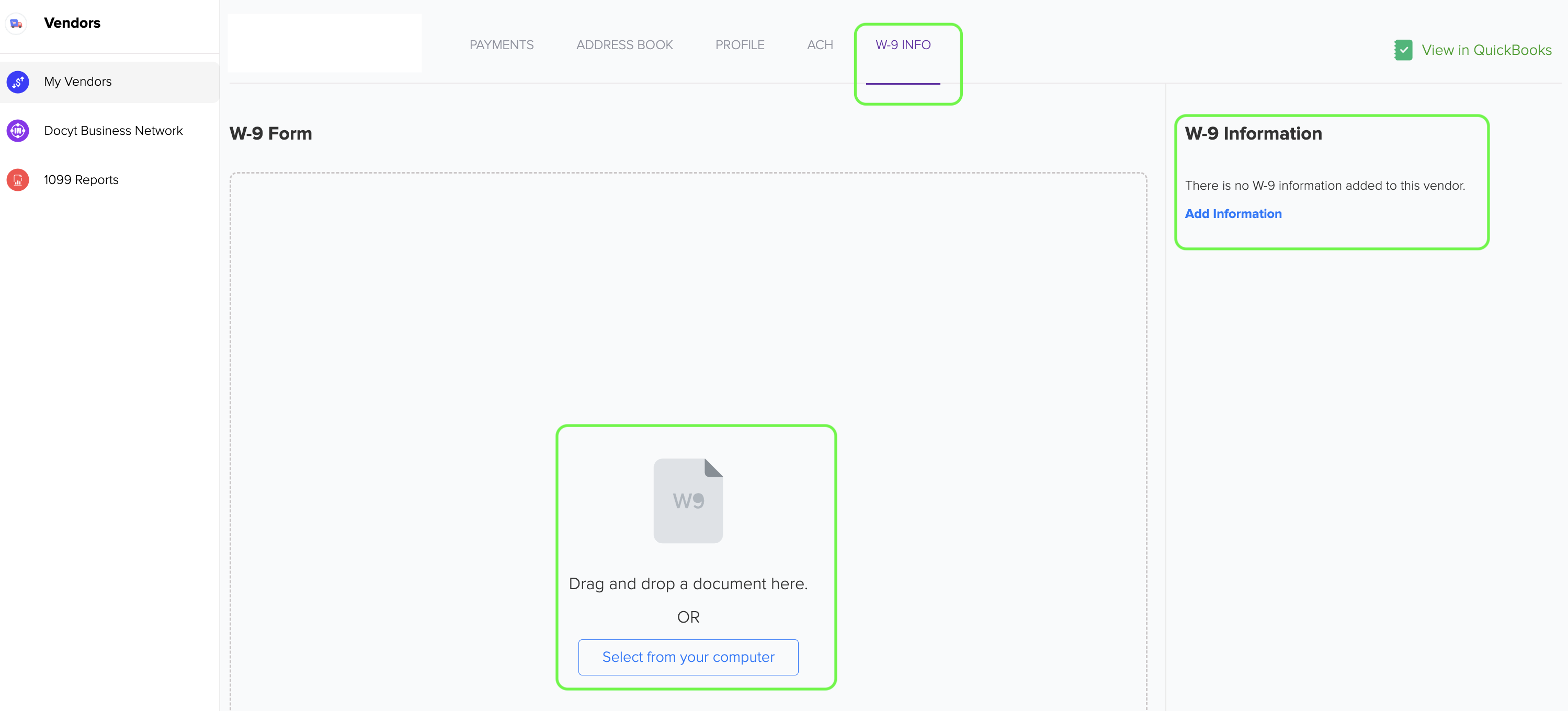

- To include W-9 information for vendors eligible for NEC, go to the 'My Vendors' list and click on a particular vendor name. Then, navigate to the 'W-9 INFO' tab of that vendor. Upload the vendor's completed W-9 pdf form for documentation by clicking the 'Select from your computer' link. Finally, click 'Add Information' to add the W-9 details of that vendor.

- By adding W-9 information, the 1099 eligibility report generated by Docyt will automatically populate with the data provided in the W-9 form.

C. 1099 Reports

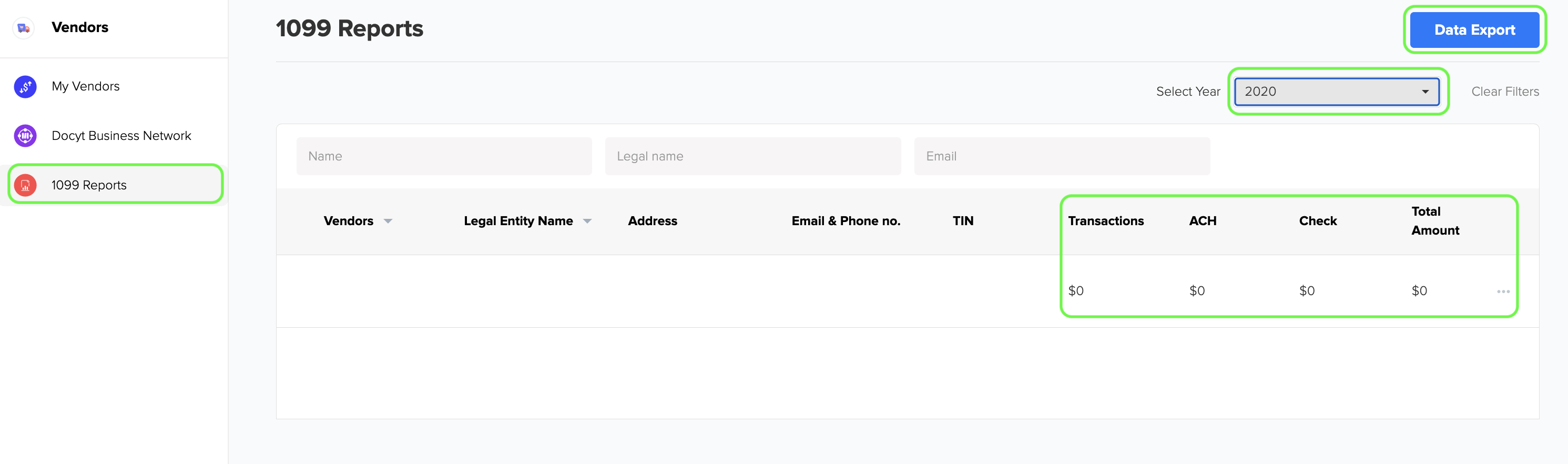

- To access the list of vendors being tracked for 1099 report generation in Docyt, go to the '1099 Reports' menu option on the screen's left side. Here, you will find a comprehensive list of vendors, along with their total payment amounts received through bank transactions, ACH transfers, and checks for the selected tax year. To export this data, click the 'Data Export' button.

- Once you click the 'Data Export' button, a CSV file named eligibility_1099_reports.csv will be downloaded to your computer.

- From the CSV file, you can identify the vendors who have received more than $600 in non-employee compensation during the specific tax year. Once you have recognized these vendors, you can fill out the 1099-NEC forms for them and submit them to the IRS.

- In addition, Docyt offers the option to submit your 1099-NEC forms to the IRS for a small fee if you choose to utilize this service. This valuable service saves valuable time and ensures that your tax reporting responsibilities are fulfilled accurately and efficiently. Just to let you know, the deadline for submitting 1099-NEC forms to the IRS and recipients (vendors) is January 31st.

If you need help generating a 1099 eligibility report or filing a 1099-NEC form, you can contact your Docyt Account Manager or contact Docyt support at support@docyt.com. They will be happy to help you with any questions or concerns.