Deposit Tracking in Docyt Revenue Center

Docyt's deposit tracking feature is a valuable tool that offers a complete and detailed overview of daily revenue. It simplifies tracking income from different merchant processors and reconciling them with bank deposits.

1. To access the Revenue Center, go to the main menu and click 'Revenue Reconciliation'. From there, select 'Revenue Center' to proceed.

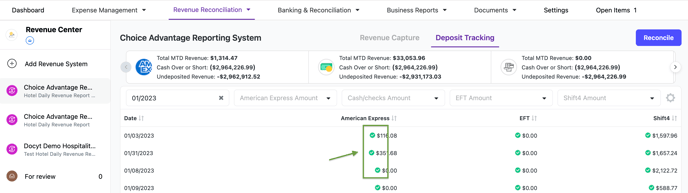

2. To access the Deposit Tracking feature, select 'Deposit Tracking' from the left-side navigation menu on the 'Revenue Center' page.

3. To set up deposit tracking for the first time, you will be prompted to activate the feature. Click on the 'Activate Deposit Tracking' button to get started.

4. A pop-up window will appear, prompting you to select the date for the last deposit reconciliation. Choose the date that is appropriate for your needs. To activate the deposit tracking feature, click the 'Activate' button.

5. After selecting the date, you will be directed to the deposit tracking view. Here, you can quickly review your daily revenue from each payment processor by choosing the date or month. To ensure that your daily revenue matches your daily income deposits, click the 'Reconcile' button at the top of the page.

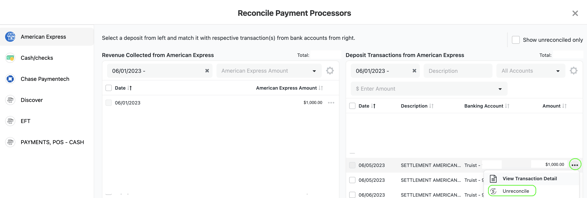

6. The 'Reconcile Payment Processors' window will open, displaying a left navigation menu that shows the list of payment processors. From there, you can select the payment processor you want to reconcile. On the left side of the window, you will see the revenue collected from the payment processor, while on the right side, you will see the deposit transactions in the bank from the payment processor. You can choose the date and then select the revenue-received item on the left side. Select the matching deposit on the right side and click the 'Reconcile' button.

If there is a difference in some amount when reconciling the data, in this case, the cash is short. This is termed as 'Cash Over or Short.' Cash over or short can be positive or negative. When deposits are higher than revenue, they will be shown as negative values (In brackets). When Deposits are lesser than Revenue, they will be shown as positive values (Without brackets)

7. A notification confirming the successful reconciliation will be shown.

8. When a revenue entry is successfully matched with a bank deposit, you will see a green checkmark indicating that it has been reconciled.

9. If you accidentally match a revenue item with the wrong deposit, you can quickly rectify the situation. Navigate to the 'Reconcile Payment Processors' section, locate the deposit in question, and click on the three dots menu. From there, select the option 'Unreconciled,' and the incorrect matching will be undone.

Benefits of Utilizing Deposit Tracking:

1. Get a constant and detailed view of earnings organized by payment processors.

2. Enhance understanding of revenue from different sources, increasing visibility.

3. Guarantee precise and error-free depositing of daily earnings into the bank, reducing discrepancies.