Hospitality Non-Operating Income and Expenses Report (Schedule-11)

Table of Contents

- Accessing the Report

- Report Customization

- Excel or PDF Format Export

- Report Content Breakdown

- Advantages of the Report

- Sample Report

- Troubleshooting Inaccurate Data

Accessing the Report

- Log in to your Docyt account.

- From the top navigation menu, select 'Business Reports' from the drop-down menu. In the subsequent menu, choose 'Departmental Reports'.

- On the Departmental Reports page, locate and click the 'Non-Operating Income and Expenses' option to access the report.

- Customize the report parameters by selecting the desired period and column views.

- Incorporate Budget columns into your reports. Click here to learn more.

- Generate the report and review the detailed results to gain valuable insights into revenue performance and financial accuracy.

Limited Access: This report is exclusively available for select Docyt Plans. If you don't have access, please contact support@docyt.com for help.

Report Customization

1. Use the drop-down menu in departmental reports to add new columns based on the selections.

2. Click 'Customize' to add new columns to the report, namely Percentage Column, Last Year, Per Available Room (PAR), Per Occupied Room (POR), and Budgets Comparison.

3. You can also customize the report columns for multiple months.

4. The table below provides the formula for calculating PAR $ (Per Available Room) and POR $ (Per Occupied Room) for both the Period to Date and Year to Date, respectively. This information can be found in row 3 of the below table.

| PTD (Period To Date) | YTD (Year To Date) | ||||

| PTD $ | PAR $ | POR $ | YTD $ | PAR $ | POR $ |

|

PTD Amount |

(PTD Amount) ÷ (Rooms Available to Sell) |

(PTD Amount) ÷ (Rooms Sold) |

YTD Amount |

(YTD Amount) ÷ (Rooms Available to Sell) |

(YTD Amount) ÷ (Rooms Sold) |

5. You can also customize the columns in the report at the first level of data drill-down using the drop-down menu. This allows you to personalize the report further and tailor it to your needs.

To export your report to Excel or PDF format

- Generate and review the desired report in Docyt.

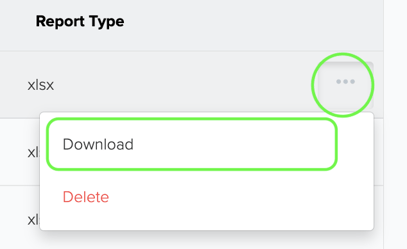

- To export your report to Excel or PDF format, go to the top right corner of the report page and find the three-dots menu icon (...). Click on the three dots to reveal the menu options, and from there, select 'Export as Excel' or 'Export as PDF'.

- A notification will appear, indicating that the report can be downloaded from the 'Data Export' section of Docyt.

- To download the report, navigate to the 'Data Export' section by clicking the 'Data Export' link in the notification. Click the ellipsis menu on the 'Data Export' page and select the 'Download' option.

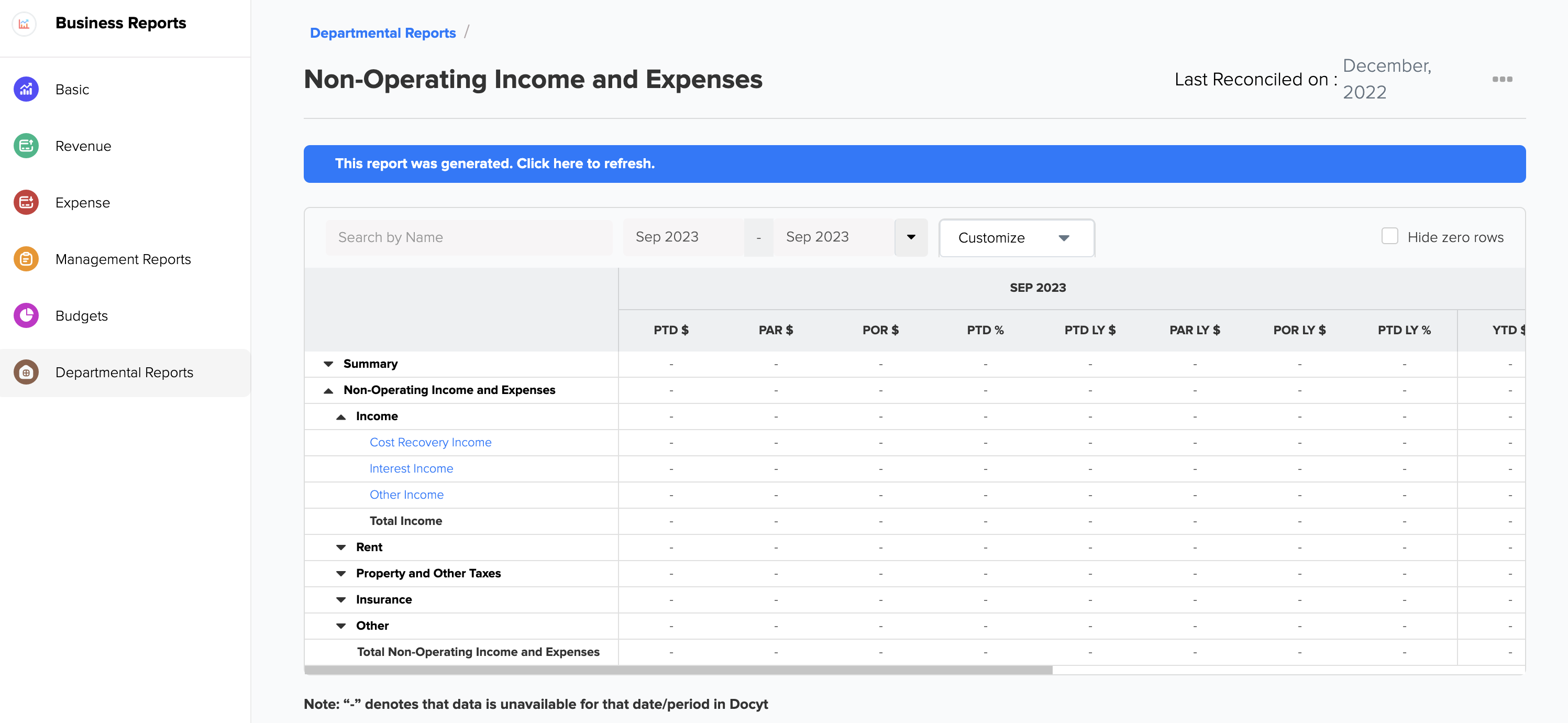

Components and Sections of the Report

The report provides a detailed analysis of the components contributing to non-operating income and expenses. By reviewing this information, you can gain valuable insights into your overall financial performance and better understand the factors impacting your financials.

Here is a breakdown of the different line items included in the Non-Operating Income and Expenses—Schedule 11:

1. Income

- Cost Recovery Income: This category records the income from third parties to cover standard area maintenance (CAM) and out-of-pocket expenses when the property is not making a profit.

- Interest Income: This category includes interest income earned from funds that are deposited in reserve or restricted accounts and generate interest.

- Other Income: This category records any additional income generated by the facility unrelated to its regular operations or the operator's management. For example, income from leasing out antenna, billboard, and retail space in the building and CAM recovery for areas directed and managed by the owner is recorded here.

2. Rent

Rent expenses encompass the costs related to leasing and renting property and equipment. This includes expenses for operating leases, ground lease rent, and property and equipment rentals, except those rented for a specific function or event.

- Land and Buildings: If the property is leased on a ground lease or under an operating lease, this line item includes the base lease payment and any additional rent. This applies to property leases for facilities or complexes that provide housing for employees.

- Other Property and Equipment: This category includes rentals of significant items like vehicles, copy machines, and information or telecommunications equipment. It also covers off-site storage rent due to space limitations on the premises, which hotel staff manages.

3. Property and Other Taxes

- Business and Occupation Taxes: This line item includes taxes such as gross receipts tax on the sale of rooms, food, and beverages that cannot be transferred to customers.

- Other Taxes and Assessments: This line item records any taxes or assessments unrelated to income, payroll, or the ones mentioned above. These taxes or assessments are charged to this specific line item.

- Personal Property Taxes: This line item records furnishings, fixtures, and equipment taxes.

- Real Estate Taxes: This line item reflects the taxes imposed on real property by a government or public agency. It includes all the taxes that are assessed against the property.

4. Insurance

- Building and Contents:

The insurance cost for protecting the business building and its contents from damages caused by fire, weather, sprinkler leakage, terrorism, flood, boiler explosion, plate glass breakage, or any other cause is recorded in this account.

- Liability

- Deductible:

It covers the amounts that must be paid due to deductibles and self-insured retentions in insurance claims.

5. Other

- Cost Recovery Expense

- Gain/Loss on Fixed Assets

- Owner Expenses

- Unrealized Foreign Exchange Gains or Losses

6. Total Non-Operating Income and Expenses

The Total Non-Operating Income and Expenses are calculated by adding up the amounts for Rent, Property and Other Taxes, Insurance, and Other non-operating expenses, then subtracting the non-operating Total Income amount from this sum.

Sample Report

What To Do If Your Report Data Is Not Accurate

For inaccurate data:

- Consult with your Docyt Account Manager for guidance and resolution.

- For general support questions, please email Docyt support at support@docyt.com for help troubleshooting and resolving discrepancies.

Benefits

By utilizing Docyt's Hospitality Departmental Report Schedule 11, you can enjoy the following benefits:

-

Financial Analysis: Gain insights into your non-operating income and expenses to evaluate your financial performance.

-

Comprehensive Overview: Understand the components contributing to your non-operating income and expenses for a holistic view of your financials.

Hospitality Brands that Trust Docyt

Docyt is a Hospitality and Lodging Industry Partner

We greatly appreciate your feedback!

👍 Vote for helpfulness! Your feedback matters. Let us know if our articles are helpful to you. Your vote counts!