Hospitality Administrative and General Expenses Report (Schedule 5)

Table of Contents

- Accessing the Report

- Report Customization

- Excel or PDF Format Export

- Report Content Breakdown

- Advantages of the Report

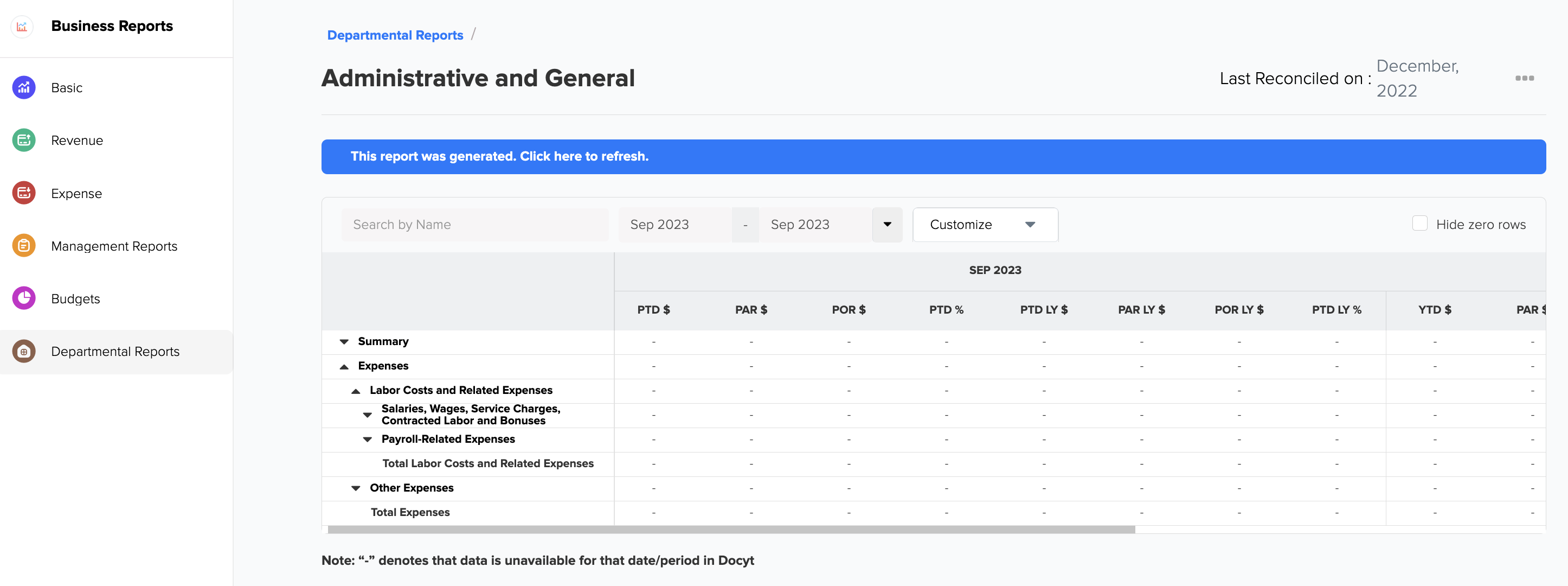

- Sample Report

- Troubleshooting Inaccurate Data

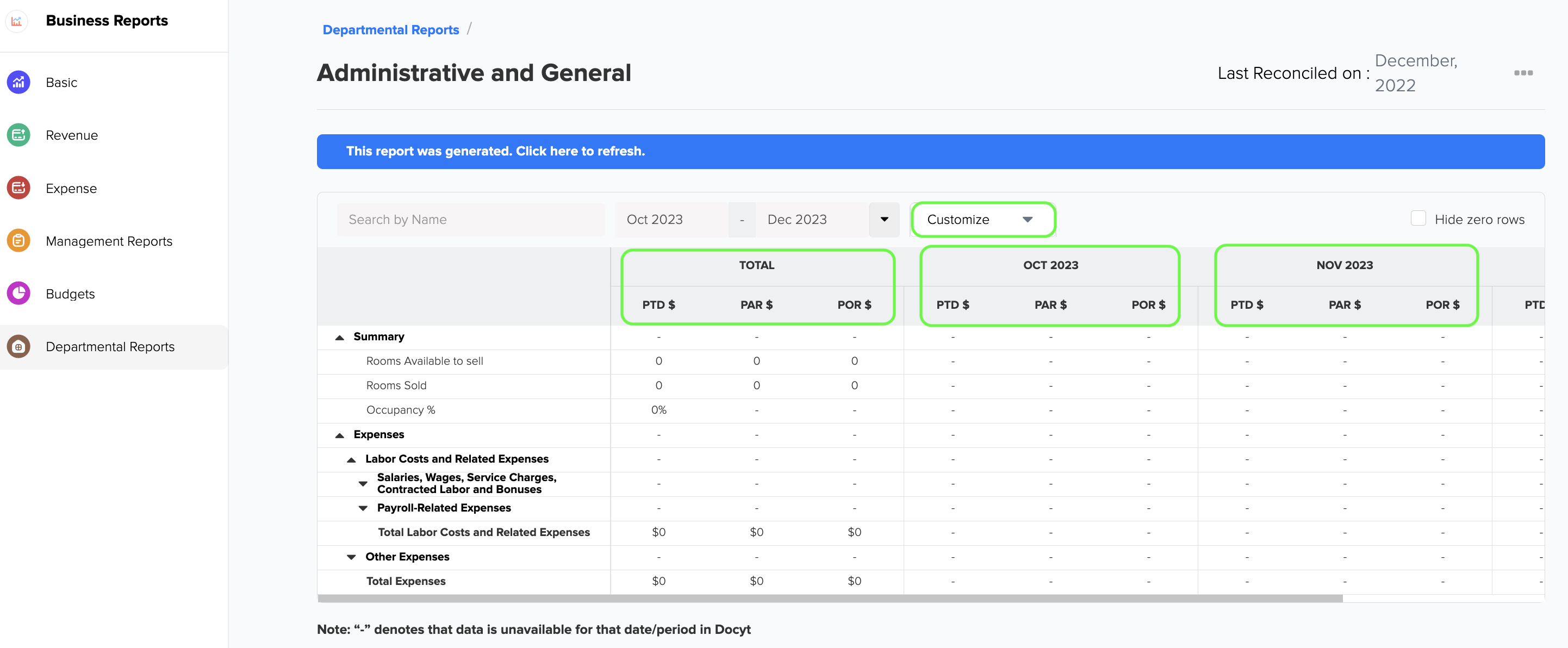

Accessing the Report

- Log in to your Docyt account.

- From the top navigation menu, select 'Business Reports' from the drop-down menu. In the subsequent menu, choose 'Departmental Reports'.

- On the Departmental Reports page, locate and click the 'Administrative and General' option to access the report.

- Customize the report parameters by selecting the desired period and column views.

- Incorporate Budget columns into your reports. Click here to learn more.

- Generate the report and review the detailed results to gain valuable insights into revenue performance and financial accuracy.

Limited Access: This report is exclusively available for select Docyt Plans. If you don't have access, please contact support@docyt.com for help.

Report Customization

1. Use the drop-down menu in departmental reports to add new columns based on the selections.

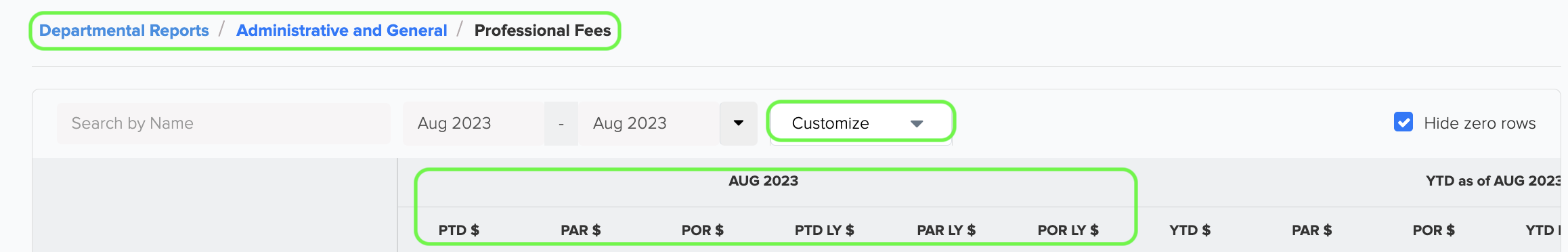

2. Click 'Customize' to add new columns to the report, namely Percentage Column, Last Year, Per Available Room (PAR), Per Occupied Room (POR), and Budgets Comparison.

3. You can also customize the report columns for multiple months.

4. The table below provides the formula for calculating PAR $ (Per Available Room) and POR $ (Per Occupied Room) for both the Period to Date and Year to Date, respectively. This information can be found in row 3 of the below table.

| PTD (Period To Date) | YTD (Year To Date) | ||||

| PTD $ | PAR $ | POR $ | YTD $ | PAR $ | POR $ |

|

PTD Amount |

(PTD Amount) ÷ (Rooms Available to Sell) |

(PTD Amount) ÷ (Rooms Sold) |

YTD Amount |

(YTD Amount) ÷ (Rooms Available to Sell) |

(YTD Amount) ÷ (Rooms Sold) |

5. You can also customize the columns in the report at the first level of data drill-down using the drop-down menu. This allows you to further personalize and tailor the report to your needs.

Export Report to Excel or PDF format

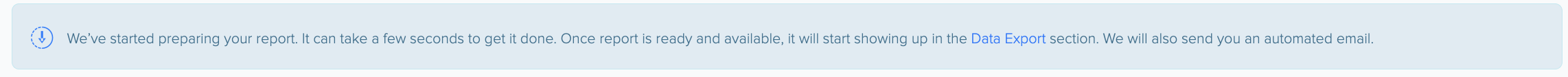

- Generate and review the desired report in Docyt.

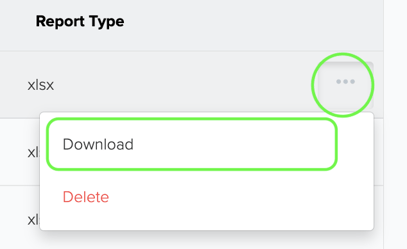

- To export your report to Excel or PDF format, go to the top right corner of the report page and find the three-dots menu icon (...). Click on the three dots to reveal the menu options, and from there, select 'Export as Excel' or 'Export as PDF'.

- A notification will appear, indicating that the report can be downloaded from the 'Data Export' section of Docyt.

- To download the report, navigate to the 'Data Export' section by clicking the 'Data Export' link in the notification. Click the ellipsis menu on the 'Data Export' page and select the 'Download' option.

Components and Sections of the Report

The Schedule 5—Administrative and General Expenses report in Docyt provides a comprehensive breakdown of expenses related to administrative and general functions in the hospitality industry. Administrative and General expenses are separated into two major categories: Labor Costs and Related Expenses and Other Expenses.

1. Labor Costs and Related Expenses

Labor Costs and Related Expenses encompass all the costs related to payroll, including Salaries, Wages, Service Charges, Contracted Labor, Bonuses, and Payroll-Related Expenses for both employees and contractors.

Salaries and Wages: This category includes the earnings paid to employees for their work related to the operation of the property. It covers regular pay, overtime pay, and shift differential pay. If an employee works in a department different from their regular home department, their earnings will be charged as Salaries and Wages in that department, regardless of the specific duties they perform.

Service Charge Distribution: This category covers the expenses associated with service charges paid to hotel employees through the payroll system.

Contracted, Leased, and Outsourced Labor: This category includes the total cost of contracted, leased, and outsourced labor that occurs when a property forms an agreement with a third-party contractor to hire employees for positions typically filled by individuals on the regular payroll. In these situations, the proper records of the hours worked and compensation for the third-party contractor are based on an hourly rate or another agreed-upon method.

Bonuses and Incentives: This category includes bonuses that are part of contracts or given at the company's discretion, as well as incentive pay and other types of performance-based compensation. These bonuses and incentives motivate employees to increase sales, drive profits, and enhance guest satisfaction.

Payroll-Related Expenses: These include Payroll Taxes, Supplemental Pay, and Employee Benefits.

2. Other Expenses

Other Expenses in this report refer to the significant expenses incurred by the Administrative and General departments, which are approved and categorized as such in the Uniform System.

Audit Charges: This category covers the expenses incurred for conducting internal and external accounting audits for the property.

Bank Charges: This category includes charges for various banking services and transactions, including overdrafts, monthly service fees, stop payments, check fees, wire transfer fees, bank transfer charges, and other related expenses.

Cash Overages and Shortages: This category includes instances where cashiers have more or less money than they should have in their cash registers.

Centralized Accounting Charges: This category covers the expenses associated with centralized accounting services, such as fees for accounts payable, preparing income statements, processing payroll, and preparing sales/use/occupancy tax. These expenses are assessed by either the corporate office or the management company.

Cluster Services: This category includes allocating costs shared among hotels within a specific geographic area. It is important to note that these shared costs are not consolidated nationally like the services provided by the Corporate Office Reimbursable.

Some other line items under Administrative and general expenses under the Other Expenses category are:

Complimentary Services and Gifts, Contract Services, Corporate Office Reimbursable's, Credit and Collection, Credit Card Commissions, Decorations, Donations, Dues and Subscriptions, Entertainment—In-House, Equipment Rental, Human Resources, Legal Services, Licenses and Permits, Loss and Damage, Miscellaneous, Non-Guest-Related Foreign Currency Exchange Gains (Losses), Operating Supplies, Payroll Processing, Postage and Overnight Delivery Charges, Professional Fees, Provision for Doubtful Accounts, Security, Settlement Costs, Staff Transportation, Training, Travel—Meals and Entertainment, Travel—Other, Uniform Costs, and Uniform Laundry

3. Total Expenses

Total Expenses are calculated by adding Total Labor Costs and Related Expenses to Total Other Expenses.

Sample Report

What to do if Report Data is not Accurate

For inaccurate data:

- Consult with your Docyt Account Manager for guidance and resolution.

- For general support questions, please email Docyt support at support@docyt.com for help troubleshooting and resolving discrepancies.

Benefits

-

Expense Analysis: Gain a detailed breakdown of administrative and general expenses to track and analyze expenditure patterns effectively.

-

Financial Optimization: Identify areas for cost reduction, budget reallocation, and process improvement to optimize financial performance.

Hospitality Brands that Trust Docyt

Docyt is a Hospitality and Lodging Industry Partner

We greatly appreciate your feedback!

👍 Vote for helpfulness! Your feedback matters. Let us know if our articles are helpful to you. Your vote counts!