ACH Payment and Micro-Deposits Processing Timelines

Understanding the expected delivery times for your ACH payments within Docyt and the Micro-Deposits Timeline

1) Standard ACH and Next-Day ACH Timeline

2) Micro-Deposits Timeline

1) Standard ACH and Next-Day ACH Timeline

Docyt offers two options for processing ACH: Standard ACH and Next Day ACH. When processing payments with Docyt ACH, it is important to keep these processing timelines and costs in mind.

It is crucial to remember that all ACH transactions must be generated before 4 PM CST. If ACH Payments are not processed by this time, they will not be initiated until the next business day. Once the ACH has been initiated, the ACH timelines start.

In addition, processing payments near the weekends will affect timelines as these days are not included in the estimated timeline. These ACH transactions only progress on business days.

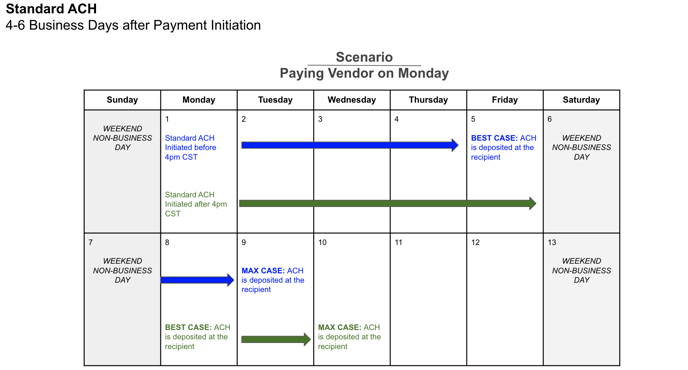

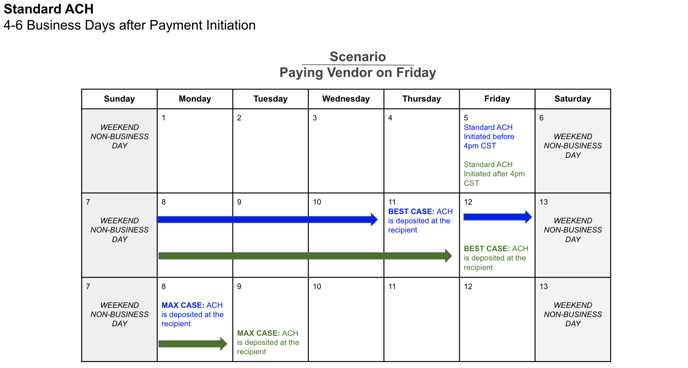

i) Standard ACH:

Price: $0.50 per ACH Transaction

Timeline: 4-6 Business Days

Let’s illustrate the timelines of the ACH transfers depending on when they are initiated:

Scenario 1: Paying Vendor on Monday

Scenario 2: Paying Vendor on Friday

When initiating on a Friday, it is important to remember that the payments do not move on the weekends; they are only moved during business days.

ii) Next Day ACH:

Price: $2.50 per ACH Transaction

Timeline: 1 - 2 Business Days

Here is an illustration of the timelines of Next Day ACH transfers:

Scenario 1: Paying Vendor on Monday

Scenario 2: Paying Vendor on Friday

When initiated on a Friday after 4 PM CST, they will not be initiated until the following Monday, so the transfer would be delivered the following Tuesday.

2) Micro-Deposits Timeline

Dwolla Micro-Deposits is a verification method for linking and verifying a bank account with Dwolla, a platform that facilitates ACH (Automated Clearing House) payments and transfers.

The Dwolla Micro-Deposits Timeline refers to the process and time frame involved when Dwolla verifies a bank account by sending small deposits, usually between $0.01 and $0.10, to that account. This is a standard method to ensure that the linked account is accessible and owned by the person attempting to connect it.

Timeline Overview: Here’s a breakdown of how it works.

| Initiation (Day 0) | Deposit Arrival (1-2 Business Days) | Verification (After Deposits Appear) | Completion |

| After a user initiates the account verification process, Dwolla sends two small deposits to the bank account. |

Depending on the bank's processing times, the micro-deposits typically take 1 to 2 business days to appear in the user's bank account. |

- Once the deposits are visible in the account, the user must log back into Docyt and enter the exact amounts of the two deposits.

|

The entire process, from initiation to completion, usually takes 2 to 3 business days. |

Key Points to Remember:

- Verification will proceed once the user confirms the micro-deposit amounts.

- If the user enters the amounts incorrectly multiple times, the verification process might be locked, requiring further resolution steps.

- This timeline ensures that only the rightful owner of the bank account can link it to their Dwolla account, adding a layer of security to the process.