Cash Flow Report for Quick Service Restaurants

Table of Contents

- Accessing the Report

- Excel or PDF Format Export

- Report Content Breakdown

- Advantages of the Report

- Troubleshooting Inaccurate Data

Accessing the Report

- Log in to your Docyt account.

- From the top navigation menu, select 'Business Reports' from the drop-down menu. In the subsequent menu, choose 'Management Reports.

- On the Management Reports page, locate and click the 'Cash Flow' option to access the report.

- Customize the report parameters, such as selecting the desired period.

- Generate the report and review the detailed results to gain valuable insights into revenue performance and financial accuracy.

Limited Access: This report is solely available to select Docyt Plans. If access is an issue, please get in touch with support@docyt.com for help.

To export your report to Excel or PDF format

- Generate and review the desired report in Docyt.

- To export your report to Excel or PDF format, go to the top right corner of the report page and find the three-dots menu icon (...). Click on the three dots to reveal the menu options, and from there, select 'Export as Excel' or 'Export as PDF'.

- A notification will appear, indicating that the report can be downloaded from the 'Data Export' section of Docyt.

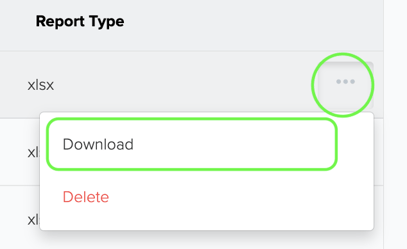

- To download the report, navigate to the 'Data Export' section by clicking the 'Data Export' link in the notification. Click the ellipsis menu on the 'Data Export' page and select the 'Download' option.

Components and Sections of the Report

A cash flow report, also known as a cash flow statement, typically consists of three main components:

-

Operating Activities: This section includes cash inflows and outflows directly related to the core operations of the business. It encompasses transactions such as cash received from customers, payments to suppliers, wages paid to employees, and taxes paid.

-

Investing Activities: This section covers cash flows related to investments in assets or securities. It includes cash inflows from the sale of assets (e.g., property, equipment, investments) and cash outflows for the purchase of such assets. Investing activities also encompass loans made to other entities or cash received from the repayment of those loans.

-

Financing Activities: This section deals with cash flows related to the financing of the business. It includes cash received from issuing stock or bonds, as well as cash paid out as dividends to shareholders or interest payments to creditors. Financing activities also cover borrowing and repayment of loans.

The cash flow statement provides insights into how cash is generated and used by a company during a specific period, offering valuable information about its liquidity, solvency, and ability to fund operations, investments, and financing activities.

Benefits

- Increased Financial Transparency: The Cash Flow Report delivers a succinct, readily understandable overview of your restaurant's cash transactions.

- Data-Driven Decision-Making: The insights extracted from the report allow you to make proactive, informed financial decisions, ensuring optimal resource distribution and preparedness to take advantage of fresh opportunities.

What To Do If Your Report Data Is Not Accurate

For inaccurate data:

- Consult with your Docyt Account Manager for guidance and resolution.

- For general support questions, please email Docyt support at support@docyt.com for help troubleshooting and resolving discrepancies.